Partner

t: +61 2 9260 2803+61 2 9260 2803

m: +61 408 751 683+61 408 751 683

o: Sydney

Global Insurance Law Connect

Global Insurance Law Connect - Property Catastrophe and Climate Governance Report | November 2025

Global Insurance Law Connect (GILC) has announced the publication of its inaugural Property Catastrophe and Climate Governance Report, bringing together insights from 23 member firms across the globe. The comprehensive study explores the rapidly evolving landscape of natural catastrophe (nat cat) risks, the challenges facing property owners and insurers, and the innovative solutions required to bridge the growing protection gap.

Key themes emerging from the report include the mounting impact of climate change on insured and uninsured losses and the vital role of government schemes and insurance innovation in building resilience.

Cost of catastrophes escalating across the board

The report underscores the transformation underway in the property insurance market, driven by the increasing frequency and severity of weather events, urbanisation, and changing land use. It highlights how the escalating cost of catastrophes – both insured and uninsured – is putting significant strain on markets worldwide.

Gillian Davidson, Chair of GILC, comments, ‘Our new property catastrophe report captures the urgency of the protection gap challenge. As climate-driven perils intensify, insurers, governments and property owners are all grappling with the affordability and availability of insurance, particularly in high-risk areas. Building resilience is not just a technical challenge, but a societal imperative.’

In Australia, extreme weather events are becoming more frequent and severe, with cyclones, floods, bushfire, and coastal erosion posing an increasing threat to communities across the country. Since 2020, according to the Insurance Council of Australia’s statistics, there have been 14 declared catastrophes across Australia and 8 significant events. A great deal depends on the broader government response to climate change, and the extent to which government policy drives better risk mitigation practices. In the absence of these commitments, the financial burden on the insurance market will inevitably impact the cost of claims and the availability of insurance coverage in certain geographical areas.

Markets under strain drive collective, innovative responses

The report details how rising claims and economic losses are leading to tighter policy wordings, increased exclusions, and in some cases, market withdrawals from high-risk territories. Governments are increasingly stepping in with regulatory reforms to maintain insurability and protect communities.

In Australia, there is an increasing risk of property being uninsurable in certain regions of the country, with industry calling on governments and local councils to tighten planning laws and increase building standards as part of mitigating risk and enhancing climate resilience.

Despite these pressures, the report notes encouraging developments, including clearer policy language, greater incentives for risk mitigation, and the adoption of co-insurance and parametric solutions that enable faster recovery following catastrophe events.

Parametric insurance, catastrophe risk pools and technology-driven risk assessment tools are highlighted as key mechanisms for closing the protection gap. These innovations offer faster claims settlement, coverage for hard-to-insure events, and greater certainty for policyholders.

In Australia, there is a growing market for parametric insurance, driven by the increase in extreme weather events, a widening protection gap in traditional insurance, and the faster payouts that parametric solutions can offer. A number of innovative products including parametric components have recently entered the market, underwritten by specialist MGAs. There is also a widespread increase in the use of technology, particularly artificial intelligence, to model and predict outcomes, which is likely to bring significant change.

Building resilience for the future

The overarching message of the Report is clear: the insurance industry has a critical role to play in shaping a more resilient and sustainable future. By fostering collaboration, incentivising risk mitigation and embracing innovation, insurers can help communities withstand and recover from natural disasters.

Gillian Davidson concludes, “The growing collaboration between all parties worldwide offers real hope that we can proactively manage natural disaster risk while maintaining the financial stability of communities and markets.’

Click here to access the full report.

Global Insurance Law Connect - Risk Radar 2025 | May 2025

In this seventh edition of the Risk Radar, we are pleased to bring you entries from 23 member firms across 5 continents. This year, contributions highlight both a number of unique, localised risks but also many that transcend international borders and jurisdictional boundaries.

Changes to regulatory environments feature heavily for many European members who are monitoring the impact of the Digital Operational Resilience Act and the revised Network and Information Security Directive, but firms in the four corners of the globe, including those in China, Brazil and New Zealand also highlight significant legislative changes in their own jurisdictions.

Climate change is significant and that is reflected across the whole report, with the intensifying consequences of natural disasters reported across the globe. Cyber and AI also remain top of mind; digitalisation of distribution channels is discussed by Finland, and Australia and Switzerland are monitoring shifting cyber risks.

For Australia, it is noted that the commercial insurance market is poised for steady growth into 2025, driven by increasing demand to address emerging risks such as cyberattacks, climate-related disasters, and regulatory challenges. These factors underscore the expanding need for comprehensive insurance coverage, highlighting the market's potential.

However, this growth faces significant headwinds, including increasing scrutiny of what some consider to be an overconcentrated insurance market, cost-of-living pressures on consumers, and the escalating cost of reinsurance. These challenges contribute to rising premiums and limited insurance availability, which could hinder accessibility and complicate the market's upward trajectory. While demand is set to grow, these obstacles may restrain the market's full potential.

The top three risks noted for Australia are:

- Australian insurance regulatory landscape

- Cyber risk and shifting dynamics

- Climate change and sustainability pressures.

You can read the full report here.

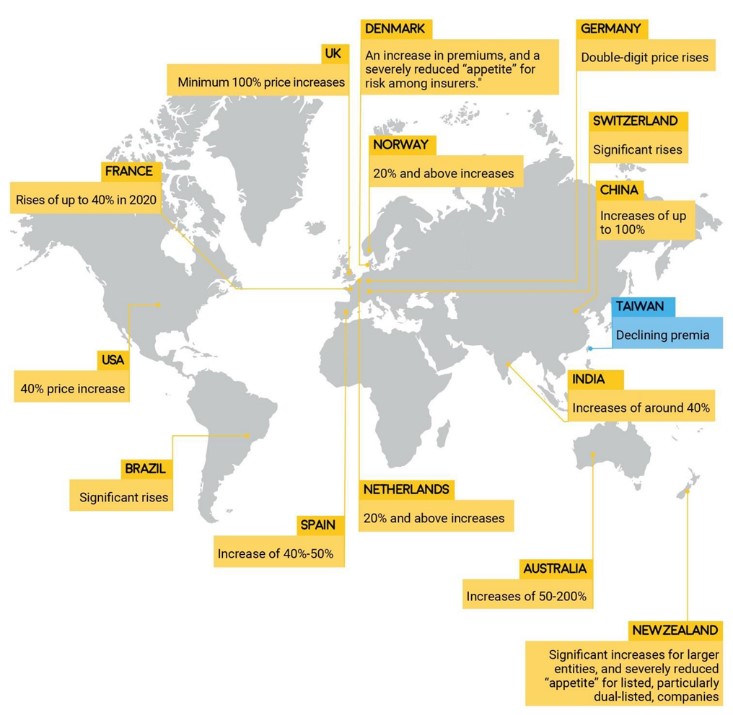

Global Insurance Law Connect - D&O Global trends 2025: increased regulation, ESG exposure and macro-economic risk dominate as more claims upheld | February 2025

Global Insurance Law Connect (GILC) has launched its second report on trends in the global Directors and Officers’ insurance sector. In it, respondents from 24 of GILC’s member firms provide insights on the range of issues faced by directors and officers, and discuss the increase in demand for D&O cover.

Key themes driving this growth include a focus on the impacts of regulation and sanctions, increasing attention on environmental, social and governance (ESG), and the ongoing challenges from a rapidly evolving cyber and artificial intelligence (AI) space.

A changing global picture

Since the first edition of this report in 2021, member firms report a widening basket of risks across the D&O landscape. In 2025:

- Legislation and regulation are a primary concern for 73% of respondents

- Over half the respondents (55%) have expressed concerns around ESG factors and macro-economic conditions.

- Eleven firms cite cyber risk as having a strong influence on D&O market response.

In 2021, prices were rising across the board, with the dual pressures of growing cyber exposure and escalating regulatory pressure top of mind for many respondents. However, the range of concerns has broadened over the last four years with ESG factors and macro-economic conditions joining cyber and regulatory as major issues for directors and officers.

Interest in D&O rising across the board

Many firms reported increased interest in D&O cover, with improved penetration within the SME sector, regardless of how developed the insurance market is in their jurisdiction. European firms in particular describe a widening awareness and desire for D&O cover among smaller companies and those in non-profit sectors.

Gillian Davidson, GILC’s Chair, commented: “Our new D&O report marks a global increase in demand for D&O cover. As the D&O basket of risk widens to include ESG and macro-economic impacts, the demand for D&O cover has also grown globally, with increased interest from smaller firms, who would not previously have considered D&O a core risk for their business.

“Most noticeable among the growing list of issues is the rise of ESG, which many member firms place among the most pressing concerns for the first time. At the same time, while regulatory concerns were already a major issue in 2021, we are now seeing that for many respondents this regulatory burden has increased to the point where they want to purchase more comprehensive cover.

“These trends typify an increasingly risky environment for executives, with rising litigation and a pattern of personal responsibility for D&Os driving up demand for broad cover across the board.”

You can download a copy of the report here.

Global Insurance Law Connect - Innovation abounds: opportunities for growth in the global MGA market | October 2024

Global Insurance Law Connect (GILC) has launched its report, Innovation abounds: opportunities for growth in the global MGA market, providing insights from 18 countries into the proliferation of MGAs in the global insurance market and the distinct regulatory environments in each jurisdiction.

The report found that the use of MGAs varies significantly around the world. In certain markets, MGAs are used to fill capacity gaps and introduce niche underwriting ideas, while in others they can help larger insurers remain innovative or showcase and support outsourcing models for claims and distribution.

Gillian Davidson, Chair of Global Insurance Law Connect, commented, “Despite some recent predictions that the MGA market would soon become saturated, GILC’s research found that it continues to be a rapidly growing market that is increasingly providing solutions the commercial and consumer markets have struggled to fulfil.”

MGAs expected to take-off in less developed markets

The report found that in multiple different ways, MGAs are healthy for the insurance market, and this is reflected in their ongoing growth and expanding geographical spread.

The US remains the largest market for MGAs, while the UK is also experiencing significant growth. The picture across Europe is more variable, with most European markets hosting some type of MGA ecosystem. Many markets are still in the early stages of development, providing opportunities for a future growth surge.

In less-developed markets, MGAs are also being recognised as a useful innovation tool and in some places, growth could be explosive. The wider Asia-Pacific market is expected to be a big growth area for MGAs including in China where MGAs remain in their infancy but are gaining ground in key financial centres. Another secondary market poised for growth is Latin America. While the maturity of the MGA sector varies greatly between markets, Brazil is leading the way with an increased relevance of MGAs in that country.

Risk innovation

Although innovation is widespread, the growth curve for MGAs shows two major themes. MGAs are used in almost every country to support expansion into niche or emerging lines and to bring innovative and cost-effective solutions to the consumer market.

Almost all countries see a growing role for MGAs in emerging and developing markets including in the technology space, and in providing cover for and assessing risks associated with climate change. They also play a role in managing claims in the aftermath of worsening natural catastrophes.

Filling niche capacity gaps

Many consider niche and emerging lines as a natural fit for MGAs to provide insurance and reinsurance capacity. This is due to the specialist underwriting knowledge available within underwriting agencies, allowing them to respond to market demand more quickly than traditional carriers.

The Australian MGA market—where MGAs are known as underwriting agencies and require an Australian Financial Services Licence to carry on financial services business—is one of the most innovative users of the structure.

For example, the consolidation of the intermediary space has continued the concentration of the broker market amongst a handful of the largest companies. The provision of back-office services—research, agent training and computer software—is increasingly provided by the larger broking networks. This means that smaller agents, dealing with clients, pay a fee for these services, which may be in the form of shared commission.

Another area that is expected to grow is around trade associations and industry bodies setting up discretionary risk mutuals for more challenging covers such as professional indemnity and public liability. The mutuals self-insure the first layer deductible and then place upper layers into the more traditional insurance markets via MGAs.

Commented Gillian, “There is a growing role for MGAs in the Australian market as risk advisors and underwriting experts, in addition to placing risks.”

MGAs as an indicator of growth and innovation for any insurance market

Gillian concluded, “Essentially, MGAs serve as an informal zone for more experimental products and ideas worldwide. Their backing by recognised capacity gives them credibility, while their independent management and underwriting allows them to think differently about how to service clients and solve new risk problems. For example, how to insure vulnerable properties in the face of climate change. These innovative attributes make them a valuable part of the global insurance ecosystem, attracting an increasing amount of GWP and interest from investors, including private equity.”

Click here to access the full report.

Global Insurance Law Connect – Risk Radar Report 2024 | May 2024

Natural disasters linked to climate change, cyber security, artificial intelligence and regulations relating to consumer protection have been identified as the biggest challenges facing insurers in 2024, according to the sixth edition of Global Insurance Law Connect’s annual Risk Radar report.

The report is a collection of insights from law firms in 26 countries, covering 29 jurisdictions. Each firm provides details on the key changes to the insurance market in their region and provides an outlook for the coming year in that country. The report provides a valuable insight into the varying – and sometimes similar – concerns of those who work in the insurance industry around the world.

Gillian Davidson, Chair of Global Insurance Law Connect commented: “We continue to see the emergence of major trends that are reshaping the insurance industry in every market and that have a significant global impact. The report shows that insurers everywhere are grappling with climate-driven disruption, responding to a heightened sensitivity to cyber threats, and embracing the potential for innovation presented by artificial intelligence, all against a backdrop of increased geopolitical risks.

“A new theme that has appeared in this year’s report is the focus on the regulatory and compliance challenges facing insurers relating to consumer protection. Customers want a fully customised and personalised experience, and regulators are pushing for a stronger focus on customers’ interests. They want more transparency, stricter regulations on insurance practices, and fair treatment of policyholders.”

In the Australian market, three issues stood out for their importance to the health of the local industry, for their recognition of dynamic industry conditions and for the ability to address the task of ensuring a sustainable insurance market as part of a well-functioning economy. These three issues are: continuing on the path to resilience in the face of ongoing natural disasters; data protection, cybersecurity, and the impact of AI; and regulatory, obligations and compliance.

Continued Gillian Davidson, “The insurance industry in Australia is on an upward growth trajectory. The mood of insurers is positive, resilient and future-focused with respect to risk mitigation strategies in support of its many stakeholder communities. The industry has concentrated on assisting those affected by climate-driven disruption, responding to a heightened sensitivity to cyber threats, and embracing the potential for innovation presented by artificial intelligence.”

The Risk Radar report covers Australia, Austria, Belgium, Brazil, Chile, China, Denmark, Finland, France, Germany, Greece, India, Ireland, Italy, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Romania, Spain, Switzerland, UAE, Ukraine, United Kingdom and the United States. Click here to access the full report.

Click here to visit the Global Insurance Law Connect website.

AI provides opportunity for insurance industry to transform itself by embracing change | February 2024

Global Insurance Law Connect (GILC) has launched its first ‘Artificial Intelligence Report’, providing insights from 18 countries (including Australia) on how artificial intelligence is impacting the insurance industry in their own markets. As well as providing details on changes to AI regulation and risk prediction and analysis, the report also finds that while AI will continue to bring greater efficiency to many areas of the insurance process, this does not come without challenges. AI algorithms may have inherent biases and lack transparency, raising concerns about data privacy and ethical issues, and the use of AI also increases the potential for cyber-related events.

Gillian Davidson, GILC’s Chair commented, “AI has already become an essential part of our daily lives and is quickly making its way into the insurance sector. This trend is expected to continue as AI offers numerous benefits including faster claims processing, improved underwriting, innovative insurance products, streamlined administration processes, and more efficient chatbots.”

Better understanding of risk

The research highlights the ability of AI to quickly analyse vast quantities of data as a powerful tool for insurers in predicting and assessing risks, particularly when there is a significant source of data. As Gillian explains, “The use of AI can help insurers enter markets that may be challenging due to lack of lengthy loss histories for certain types of risks. AI can rapidly digest large volumes of data and produce more precise analytics, which can be useful in designing coverage for large-scale cyber incidents, for example.

“Ultimately, this improved risk analysis will benefit consumers as it enables insurers to offer more relevant and tailored coverage to their customers.”

New models, new distribution

Insurers and their legal advisers will closely monitor the progress of regulations and legislation specific to AI; the EU’s forthcoming AI Act will become the benchmark for many jurisdictions around the world. They will also be keenly aware of the liability, privacy, and cyber exposures that could emerge as their policyholders adopt AI in their business models.

In Australia, the Government in January 2024 published its response to public submissions to a discussion paper on ‘Supporting Responsible AI’, which examined the need for a combination of general regulations, sector-specific regulations, and self-regulation initiatives to support safe AI practices. The Government has also said it is considering implementing mandatory guardrails for the use of AI in high-risk settings, either by amending current laws or creating new laws specific to AI. In addition, from March 2024, a new online safety code will be introduced covering search engines and providing protection against generative AI-related risks.

Jehan Mata, Sparke Helmore Partner and Cyber Insurance Leader, added, “The Australian Government needs to ensure greater collaboration with the insurance industry to provide much-needed certainty around legal, regulatory, and voluntary AI frameworks, and provide a clear roadmap for their adoption. Otherwise, Australian insurers may be hesitant to embrace AI to its full extent.”

In many markets, AI is being utilised or is likely to be adopted to optimise distribution models. The COVID-19 pandemic accelerated a shift by many insurers towards digital and online tools, replacing traditional distribution models. We are likely to see a similar rapid expansion in the use of digital techniques, including smartphone apps that often involve AI, to distribute insurance policies. This trend will be especially beneficial in markets with low insurance penetration.

AI could create new challenges

Insurers face a significant risk with regards to data privacy, which could be exacerbated by the widespread adoption of AI. The processing of vast quantities of personal and often sensitive data will mean that insurers need to have robust procedures to ensure compliance with national and international data protection standards.

Insurers also need to be mindful of the need to have measures in place to safeguard against data breaches, and to have adequate processes to handle the reporting and management of any breaches should they occur.

“For the Australian insurance industry, AI and generative AI technologies present significant opportunities and associated challenges. The use of predictive AI will need clear parameters and overarching guidance and preparedness to face the challenges across data privacy, ethics and bias in order for insurers to prevent financial, regulatory, legal, and reputational risks”, Jehan commented.

Gillian concluded, “Currently, insurance solutions tailored to the risks associated with artificial intelligence are still in the early stages of development. However, as the technology advances and becomes more prevalent, and regulatory bodies sharpen their focus, we can expect an increase in AI-targeted risk solutions.”

Click here to access the full report.

Global trends in product liability litigation and claims| October 2023

Global Insurance Law Connect (GILC) has launched its first product liability report. The report provides insights from 17 countries, including Australia, on product liability insurance in their domestic markets. The report provides details on the changes to the product liability market globally and forecasts future developments. Growing consumerism, the globalisation of supply chains, the emergence of new technologies, and the need to innovate are driving an increase in product liability claims globally.

Gillian Davidson Chair of Global Insurance Law Connect, commented: “These current and future trends in claims globally stem from a combination of consumer and regulatory pressures. While modernisation and innovation are increasingly important factors in today’s consumer society, at the same time, concerns around privacy and environmental preservation are also front of mind for many consumers. Alongside this, the growing body of legislation affording greater consumer protection rights has led to increased awareness of product liability insurance.

Some less mature insurance markets are still relatively underdeveloped, and in these markets product liability coverage is a relative newcomer and often occupies a small niche in the overall product mix. Nonetheless, the global tide of regulatory and legislative change is set to encourage consumers and corporates alike to increasingly hold manufacturers, importers and suppliers to account for the products and services that they provide.”

The research highlighted one of the latest and most rapidly evolving issues impacting product liability is artificial intelligence. As Gillian explains, “One area that has thrown up challenges for regulators and legislators alike is the unprecedented growth of new technology platforms and tools such as artificial intelligence—and particularly the speed at which they are entering the daily lives of consumers and businesses. Although regulators are making a concerted effort to introduce frameworks that will both mitigate the risks to users of this new technology and protect them from harm, many are playing catch-up, and we are likely to continue to see an increase in the number of claims.

“As awareness of product liability issues grows, the market for insurance coverage is expected to grow alongside it. In more developed insurance markets, the strengthening of consumer protections across a range of industry sectors (including the expanded definition of who or what constitutes a consumer in the eyes of regulators) is bringing more businesses into scope for potential product liability claims, driving appetite for coverage.

Australia’s product liability regime is a combination of common law, contract and the Australian Consumer Law (ACL). The ACL contains a unique prohibition on misleading and deceptive conduct, a regime of consumer guarantees, and imposes strict liability for products found to have safety defects. The ACL allows consumers to take action against suppliers, manufacturers and importers with the onus on the defendant business to seek contribution from other parties at fault; importers may be classified and deemed ‘manufacturers’ if the actual manufacturer does not have an Australian presence.

Kiley Hodges, Sparke Helmore Partner, commented, “Large product liability claims are usually commenced in the Federal Court of Australia or the Supreme Courts of the states and territories. With the recent changes and developments in case law, the defendants in product liability matters can be broad and include manufacturers, suppliers and retailers, although they are usually corporate entities. A wide spectrum of claimants also exist—from individual consumers and small businesses to large corporates and the Australian Competition and Consumer Commission depending on the scale and complexity of the matter.”

Continued Kiley, “Product liability class actions have been a well-established part of the Australian legal landscape for the last decade, aided in part by the increasing role of litigation funders and ‘no win, no fee’ lawyers. Australian product liability litigation often follows product recalls, overseas lawsuits, or regulatory investigations and enforcements.

“Class actions have more recently involved pharmaceuticals, pesticides, chemicals, medical devices, motor vehicles and a range of consumer products. Under the ACL, the definition of ‘payment of goods’ by a ‘consumer’ in respect of the breach of consumer guarantees has increased from $40k to $100k, which may also be contributing to an increase in litigation.

“A number of legislative changes were passed in November 2022 to increase penalties for companies that breach Australian competition and consumer laws. These changes include the introduction of penalties for businesses that use unfair contract terms in standard form contracts entered into with consumers and small businesses. The amendments will take effect in November 2023 allowing businesses enough time to change their standard contracts. Sparke Helmore has released three articles on unfair contract terms amendments—the articles can be accessed here, here and here).”

In closing, Gillian says, “Whether countries have the most consumer-friendly laws in the world and a mature product liability market to match, or whether they have evolving legislation and a nascent insurance market for these risks, it is clear that this class of business will continue to grow at a fast pace in the coming years.

“In this rapidly evolving market, insurers will need to be alert to new exposures and opportunities alike.”

The product liability report covers Australia, Belgium, Brazil, Chile, China, Denmark, Finland, France, India, Italy, Mexico, Netherlands, New Zealand, Norway, Poland, Spain and the United Kingdom. Click here to download the full report.

Risk Radar Report | ESG edition | May 2023

Global Insurance Law Connect (GILC) has launched its fifth annual Risk Radar report. For the first time, we zero in on a single topic — Environment, Social and Governance — and highlight its worldwide impact on the insurance industry. A collection of insights from leading specialist insurance law firms across 21 countries, the Report details the growing awareness globally of ESG risks and how the insurance industry is well positioned to respond.

GILC member firm Sparke Helmore provided the commentary for Australia and noted the three stand-out ESG issues:

- Environment: Climate change—with increasing natural disasters in Australia, insurance coverage remains both a challenge and an opportunity for innovation for the industry.

- Social-Inflation—a rising tide of living costs, supply chain issues and class actions costs. Social inflation is a key issue for the industry.

- Governance-Modern Slavery—risk management is front of mind for the insurance sector and the Insurance Council of Australia.

Gillian Davidson, Chair of Global Insurance Law Connect, commented: “It is unsurprising that the consensus from our member firms is that ESG has become an increasingly important issue for insurers and the wider business community.

“We are already seeing the significant impact of ESG on the insurance industry, for example with the dual governmental and social pressures of new regulation and stakeholder activism. The increased scrutiny of ESG strategies in many jurisdictions is also impacting directors’ and officers’ and financial institutions’ coverage, as well as professional indemnity policies for firms advising on climate related financial disclosures.

“There is recognition within the insurance industry that embracing appropriate ESG policies can lead to significant growth opportunities, the creation of long-term value, and risk management benefits. While insurers have made advances in this area, more needs to be done to meet governance and climate change risk assessment obligations.

“Members are also seeing the impact of ESG on the business community. Organisations that rely on carbon-intensive production are struggling to find insurance options, and it is increasingly difficult in many parts of the world to underwrite business for frequent and severe natural catastrophe events. In addition—against a backdrop of geopolitical risks, supply chain disruptions and inflationary pressures—organisations are coming under increasing strain as they aim to strike the right balance between ESG investments and managing increasing costs.”

The Risk Radar report covers Australia, Belgium, Brazil, China, Denmark, Finland, France, Germany, India, Ireland, Italy, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Spain, Switzerland, United Kingdom and the United States.

Click here to download the full report.

Business Interruption Report | January 2023

Global Insurance Law Connect (GILC) this week launched its first global report on business interruption, providing insights from 19 countries on business interruption insurance in their domestic markets. The Report provides details on the key changes to the global business interruption market and provides a predicted outlook for coming years.

The Report finds that following the pandemic and despite the backdrop of high inflation, increased scrutiny on wordings and higher premia, there is now more clarity for both businesses and insurers around what can be expected from a business interruption policy.

Gillian Davidson, GILC’s Chair, commented: “Business interruption insurance was thrust into the spotlight as the pandemic took hold and the world went into lockdown. The report highlights that even though businesses globally were facing similar challenges the response from the insurance industry, governments and regulators varied markedly in each jurisdiction. However, a consistent picture is that globally demand for business interruption has increased as businesses have become focussed on the need to have the right type of cover.

“Despite some short-term pressures on pricing caused by global inflation, a recent wave of cases in Asia (including a potential new variant in China) and ongoing legal challenges hanging over from the pandemic, the outlook for business interruption insurance as a class is more positive than it has been for some years. The pandemic has focused the market on the need for clarity in policy drafting and has led to a proliferation of COVID-responsive policies that either clearly exclude or include pandemic cover providing more certainty for insurers globally, and their clients.

“Consequently, business interruption insurance as a class could see a period of growth and stability at last (particularly in more traditional areas of coverage such as property damage). However, there will still be a need by some clients for pandemic cover (particularly if the recent resurgence of cases in Asia leads to renewed COVID measures and focus on such protection) and it remains to be seen what appetite insurers will have for such cover and at what cost.”

In Australia, a small number of claims have been paid out by insurers since the pandemic began. These claims have typically been submitted by companies seeing recovery under specific covers, for example, event cancellation. Insurers have contested a number of claims, and these have led to litigation.

As Mark Doepel, Partner at Sparke Helmore points out, “ Claim numbers have been low, although this is attributed to claimants adopting a ‘wait and see’ approach pending the resolution of the two BI test cases rather than decreasing demand. The test cases have and will continue to result in increased scrutiny of BI policy wordings by insurers and insureds. In the positive, the two test cases have created more certainty in the industry by confirming principles to be applied to each claim, albeit each matter will have to be determined on its facts.” Continued Mark Doepel, “BI policies will continue to be sold in the Australian market, potentially in greater numbers, given most small businesses are underinsured.”

Sparke Helmore is a member of GILC and the sole Australian representative firm. Click here to access the full report.

Click here to visit the Global Insurance Law Connect website.

Cyber Insurance report | October 2022

Global Insurance Law Connect (GILC) this week launched its inaugural Cyber Insurance report. The report captures the challenges associated with the cyber security market and analyses the different ways that regulators and insurers in different regions have been and are intending to approach this very real and constantly evolving threat.

Globally, there has been a record level rise in catastrophic losses during the last three to four years. While the majority of incidents for cyber-attacks are through ransomware, there has been an uptick in the number of state-sponsored cyber-attacks not witnessed before. The level of possible impact on businesses from cyber criminals has become increasingly clear; these include not only threats to infrastructure but also to the integrity, availability and confidentiality of the information we digitally capture, analyse and exchange.

For many buyers worldwide, the experience of buying cyber insurance cover for their business is challenging. Cyber insurance has become more expensive and can provide limited coverage, particularly outside Europe and North America.

In the short term, insurers are likely to include more caveats in policies regarding silent cyber and supply chain attacks and will also adopt more sophisticated pricing techniques. Insurers will have an increased focus on educating policyholders and providing resources to help them understand and manage cyber risk.

The reports notes that there is one certainty—that cyber insurance is a market that has the potential to become as globally ubiquitous as car and home insurance.

The Cyber Insurance report received input from Australia, Belgium, Brazil, China, Denmark, Finland, France, Germany, India, Italy, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Spain, Switzerland, Taiwan, the UK and the United States. Sparke Helmore is a member of GILC and the sole Australian representative firm.

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

Risk Radar Report | May 2022

Global Insurance Law Connect (GILC) has launched its fourth annual Risk Radar report. The report pulls together the key themes from across the GILC network and gives a snapshot of the major issues that are currently bubbling up in each major insurance destination where the GILC has a presence—23 countries.

GILC member firm Sparke Helmore provided the commentary for Australia and noted that many issues that defined 2021 remain front of mind for 2022. The top three issues that stand-out in the Australia as creating significant headwinds for the local industry are:

- Climate change—insurability or affordability of insurance in flood prone areas

- Regulation—Australian insurers have been subject to sweeping regulatory reforms

- Class actions—increasing restrictions for third party litigated funders

The 2022 report sees many of the areas of focus from last year continue to be at the forefront of members’ minds. The rise of digitisation and cyber risk, increased climate risk, and regulatory change are all themes that run through this year’s report, with insurers having to continue to adapt with 2022 being no less eventful than 2021. Many insurers have been turning their minds to the longer-term implications of the pandemic including potential consequences for the D&O market should the decisions of senior management during this extraordinary period come under the spotlight.

The Risk Radar report covers Australia, Belgium, Brazil, China, Denmark, England & Wales, Finland, France, Germany, India, Ireland, Italy, Luxembourg, Mexico, Netherlands, New Zealand, Northern Ireland, Norway, Scotland, Spain, Switzerland, Taiwan and the United States.

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

D&O: Global trends, insurance capacity and pricing | November 2021

Global Insurance Law Connect Legal network this week launches its first research report into global D&O markets. The report has had input from insurance lawyers in 20 countries around the globe and provides an overview of global trends and also gives a snapshot of how D&O coverage shapes up country by country. GILC member firm Sparke Helmore provided the input for Australia.

In many countries, D&O rates are rising, and in some places, those increases are extreme, but this is not the case everywhere. In a few markets the green shoots of recovery are showing as clients reach the limits of what they are prepared to pay, and prices look set to finally stabilise.

Australia is one such country where the price limit has been reached. As Dino Liistro, Sparke Helmore Partner, comments, “The recent experience of underwriters had been that insureds were prepared to increase their spend. The limit may have been reached. Over the last year, insureds began maintaining the same legal spend in the face of rising premiums by increasing excesses or reducing limits of cover and in some cases looking to other risk management solutions to bridge the gap.”

The report also notes other tumultuous global events beyond pricing are impacting D&O including:

- the global surge in M&A

- regulatory pressures

- cyber

- growth markets

- environmental and ESG issues, and of course

- the pandemic.

These issues add up to the increased need for protection for directors and officers, driving up the demand for cover. The report found that while emerging markets in particular have a growing appetite for D&O there is a lack of capacity in many of these markets, with only a small number of insurers operating in the region. European markets also have capacity for growth with some smaller economies showing an upward trend in demand.

Meanwhile in Asia, markets such as China that have fast-growing D&O books have also seen increased securities-related litigation and in India, the basis for D&O claims has widened exponentially.

For Australia, the COVID-19 pandemic appears to have created a volatile and uncertain environment for businesses in a strained D&O insurance market. It is anticipated however that the market will stabilise and soften over the next two years. This optimism is attributed to (now past) increases in premiums together with an apparent slowing of certain types of claims namely, securities related litigation.

Dino Liistro noted, “There has been a decline in securities and insolvency-related investigations and claims over the past 12 months. Early in the pandemic, legislative changes were made in the area of insolvency, and other legislative changes and government support assisted companies. Perhaps because of these actions there has been a decline in corporate insolvencies from pre-pandemic levels, and consequently a decline in insolvency related claims against company directors to now. In the event of insolvencies increasing in the future, of course, we may again see a rise in insolvency related claims.”

“Also related to the pandemic, underwriters anticipate further claims in the employment practices liability space—around changing conditions in workplaces—and in respect of policies with an element of crime cover.”

Cyber is another area that continues to be in the spotlight in Australia, as it is around the globe. Underwriters typically consider cyber risk to be covered under D&O insurance policies; to date, there has been very limited claims activity in Australia. Theoretically, a director’s failure to implement reasonable data protection and security controls could ground claims against them. Dino Liistro said, “I anticipate that the risks associated with such claims will grow commensurate with companies’ increasing reliance on technology and data to drive revenues and business operations.”

As Jim Sherwood, Global Chairman of Global Insurance Law Connect, states on the report overall, “The changes of the past decade and recent economic shocks have led to an increased need for protection for directors and officers, in a market that lacks capacity to supply it. The impact has been a notable growth in self-insuring for this class of cover, alongside increased use of letter of indemnity for directors and officers.”

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

GILC Economic Update: Pandemic rebound has further to run | November 2021

Over the past few months, Global Insurance Law Connect has worked together with Capital Economics to analyse global economic trends. As a result, GILC has launched a new report, which provides GILC clients with a broad view of the global economy. Insurance, as with all industries, is seeing changes to the market due to global economic pressures, and this report has been produced to give insight as well as to be used as a tool to shape insurers planning for the months ahead.

Jim Sherwood, Chairman of Global Insurance Law Connect commented, “Macroeconomics now, more than ever, impacts every aspect of the insurance value chain. Recent discussions with our members have highlighted how across the globe, demand for insurance varies by line of business. However, as economies transition to the ‘new normal’, we are likely to see growth in those classes of insurance that have fallen in the last two years.

“M&A activity within the insurance market has increased in many regions, as insurers seek to provide a full-scale offering or upgrade their technology to offer their consumers a more streamlined service. In addition, there is also a greater demand for increased transparency and competitiveness, coupled with tougher regulatory regimes. All of this is critical to our clients’ working lives.”

Click here to visit the Global Insurance Law Connect website. Download the full report here.

Risk Radar Report | June 2021

Global Insurance Law Connect (GILC) has launched its third annual Risk Radar report. The report pulls together the key themes from across the GILC network and gives a snapshot of the major issues that are currently bubbling up in each major insurance destination where the GILC has a presence—22 countries.

GILC member firm Sparke Helmore provided the commentary for Australia and noted that a number of issues stand out as having a significant impact on the local insurance industry and the way it operates. The top three issues that stand-out in the Australia as creating significant headwinds for the local industry are:

- Business interruption losses

- Marine delay coverage and supply chain challenges, and

- Cyber and privacy.

The 2021 Radar Report has seen a marked globalisation in tone. For the first time, many of the issues member law firms have reported as being currently critical in their markets have converged, with a truly universal focus on cyber, climate change and the impacts of the pandemic bringing new challenges to many markets. A subsidiary point, but one of much importance to all in our industry, is the follow-on impact of the ‘powering up’ of digital marketing, sales and claims processing, as insurance buyers around the globe move online permanently after a year of cultural change.

The global issues of cyber and the impact of the pandemic particularly, resonate in Australia. Insurers and their customers have had to be quick to respond to enable business continuity and establish a stable position in the market.

The Risk Radar covers Australia, Belgium, Brazil, China, England & Wales, Finland, France, Germany, India, Ireland, Italy, Luxembourg, Mexico, Netherlands, Northern Ireland, Norway, Scotland, Spain, Switzerland, Turkey, Taiwan and United States.

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

Sparke Helmore appointed to Zurich’s new APAC panel for large and complex losses | April 2021

Zurich Insurance has introduced a new legal panel to provide legal services for large and complex claims in the Asia-Pacific (APAC) region following last year's legal panel arrangement for Europe, Middle East, and Africa (EMEA). Sparke Helmore is delighted to confirm that through its association with Global Insurance Law Connect (GILC), it was successful in appointment to this new legal panel. This appointment complements our longstanding relationship with Zurich Australia, having been part of their legal panel nationally for several years.

Speaking to Insurance Business Australia, Zurich head of claims for APAC Matt Cottrell said: “This is great news for our customers and our broking partners who will be able to receive specialist legal advice provided by highly respected international law firms that are based in the region and have a global reach. The legal and market insights they'll provide to Zurich and our customers will be invaluable, particularly for larger, more complex claims.”

Partner Gillian Davidson (APAC Board representative for GILC and Zurich Relationship Partner), commented to say: “This recent appointment is testament to the strength of our relationship with Zurich and the quality of legal work provided by expert legal team at Sparke Helmore and across the GILC network. We are very excited by the opportunity and look forward to collaborating further with an extremely important partner in Zurich.”

Sparke Helmore is a proud member of GILC and the sole Australian representative firm. GILC is a formal network of leading insurance law experts with its formation inspired by client demand. The network is comprised of like-minded and high-performing independent firms from across the globe that specialise in insurance law.

Approaches to coronavirus | March 2021

Global Insurance Law Connect has launched its 2021 report into the impact of COVID-19 on global insurance markets. Member firms in 17 countries around the world have contributed and, drawing upon their in-depth understanding of the local jurisdiction and cultural, political and geographical challenges, the report provides a unique overview for the insurance industry. Member firm Sparke Helmore provided the commentary for Australia.

Gillian Davidson, Partner Commercial Insurance at Sparke Helmore and GILC Board Representative for Asia Pacific commented, “Since our first report on the impact of COVID-19 in July 2020, we have seen changes in the way we live and work and have only just begun to understand the challenges for businesses and economies around the world. This latest analysis highlights the common themes that are emerging—from coverage to regulatory change—as well as focusing on country specific issues.

“For example, disputes concerning business interruption have triggered challenges in numerous jurisdictions, including in Australia. We are also seeing courts continuing to adapt and implement the technological leaps and bounds made during COVID, as permanent. Another recurring theme across many member firm jurisdictions is the change in work practices and business environment as well as the acceleration in digitisation, which has seen the insurance industry move several years’ forward in just a few months.”

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

Global Run-off and Legacy Trends report |February 2021

Global Insurance Law Connect (GILC) member firm Sparke Helmore has launched its first run-off report, looking at the drivers of legacy business in both mature and emerging insurance markets. Specialist insurance law firms in 20 countries around the world have classified their local run-off market, in terms of both its maturity and direction of travel and looked at some of the dynamics behind these developments.

The best way to sum up the findings is “growth held back by legislation”. One universal truth is that in every market, insurers are looking for opportunities to divest themselves of unwanted legacy portfolios. While some of the exact drivers may differ, we see a common pattern: in markets where regulation permits portfolio transfers, creative solutions flourish with multiple parties cooperating in flexible ways and, very often, delivering a more positive outcome for those parties.

Closer to home, the Australian run-off market is starting to gain more traction and in 2021, it looks likely to continue to grow and gather momentum. Large global players are looking to run-off specialists to acquire legacy portfolios, which enables them to have a clean and decisive exit from lines of business that are taking up capital and capacity.

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

Run-off is a global trend, but local expertise is the key to success | October 2020

In 2019 PwC’s Global Insurance Market Run-Off Survey estimated global non-life run-off reserves at circa $790bn, with legacy management expected to become part of the “new normal”. The drivers are different in different regions, but the underlying trend is the same – a new focus on run-off, supplement with a growing awareness that the legislative environment is changing, meaning that deals are demanding and require technical expertise to price and complete successfully. The article first appeared in Insurance Day UK in October 2020.

Approaches to coronavirus report | July 2020

Global Insurance Law Connect this week launches its new report, “Approaches to coronavirus”. The report brings together the latest views on COVID-19 from Global Insurance Law Connect member firms in sixteen countries around the globe.

The report examines some of the common themes of coverage as well as legal and regulatory issues observed by the member firms. It also looks at the potential claims emerging and how the depth and breadth of those claims could impact a local insurance industry.

GILC member firm Sparke Helmore provided the commentary for Australia and noted that we are seeing COVID-19 have impacts in the travel, life, health, event cancellation and business interruption classes, where limits of coverage are being pushed in respect of losses associated with the pandemic. But we are also seeing impacts across liability, defence costs, financial lines and D&O classes. We think the majority of claims will be long tail claims, both in this pandemic phase but also when the recovery begins.

The Report covers Australia, Belgium, Brazil, China, England & Wales, Finland, France, Germany, India, Italy, Luxembourg, Mexico, Norway, Spain and Switzerland.

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

Risk Radar | April 2020

Global Insurance Law Connect (GILC) today launched its second annual Risk Radar report. The report pulls together the key themes from across the GILC network and gives a snapshot of the major issues that are currently bubbling up in each major insurance destination where the GILC has a presence—19 countries.

GILC member firm Sparke Helmore provided the commentary for Australia and noted that a number of issues stand out as having a significant impact on the local insurance industry and the way it operates. The top three issues that stand-out in the Australia as creating significant headwinds for the local industry are:

- climate risk

- technology, and

- war for talent.

Shortly after our members drafted this year’s report, the world was shocked by the advent of the COVID-19 pandemic and we are already seeing COVID-19 have a significant impact across multiple lines of cover. GILC will be publishing a separate guide dealing with specific coronavirus legal issues and I will share that with you in the near future.

The Risk Radar covers Australia, Belgium, Brazil, China, England & Wales, Finland, France, Germany, India, Ireland, Italy, Luxembourg, Mexico, Norway, Scotland, Spain, Switzerland, Taiwan and United States.

Click here to visit the Global Insurance Law Connect website. Click here to download the full report.

Annual Review 2019 | January 2020

Global Insurance Law Connect (GILC) this week launched its Annual Review for 2019. The compilation provides a consolidated look back at the most noteworthy articles on global insurance from major markets including Australia, Brazil, France, India, Italy, Norway, Switzerland, Taiwan, and United Kingdom—providing insight to the key issues faced by the ever-evolving industry throughout 2019.

Click here to download the full report.

Click here to visit the Global Insurance Law Connect website.

Spotlight on Emerging Markets | October 2019

As growth within the mature insurance markets stagnates, so carriers and brokers are looking for opportunities for growth in the emerging economies. When you consider that these countries include global economic giants China and India, you can see how important the “emerging” players are for insurers.

These markets are growing rapidly, which makes them exciting places to work and invest, but sometimes also higher risk. Each emerging market has its own complexities, its own legal structures, and often a distinct approach by its own government, which must be understood when considering growth prospects and possibilities for entering the market.

One of the strengths of Global insurance Law Connect is the wide membership among specialist firms in emerging (as well as established) insurance markets. As these firms have unique and well-recognised expertise in insurance law in their own markets, it was concluded that clients would find a spotlight on the local nuances of emerging market helpful—a “what’s happening now” guide for insurers who have an interest in this area.

In addition, the comparison of different markets allows readers to understand common and particular themes, and to see how different countries have tackled different growth, regulatory and economic issues.

Click here to download the full report, which is accompanied by a seminar video series presented by GILC on each of the Emerging Markets, available here.

Click here to visit the Global Insurance Law Connect website.

Risk Radar | July 2019

Global Insurance Law Connect (GILC) this week launched its first annual Risk Radar report. The report pulls together the key themes from across the GILC network and gives a snapshot of the major issues that are currently bubbling up in each major insurance destination where the GILC has a presence—15 countries listed below. Click here to download the full report.

About GILC

Sparke Helmore Lawyers is proud to be a member of GILC and the sole Australian representative firm.

GILC is a formal network of leading insurance law experts with its formation inspired by client demand. The network is comprised of like-minded and high-performing independent firms from across the globe that specialise in insurance law. What makes GILC a stand-out is its special legal and risk interest groups. We see this collective contribution of local expertise from each of the member firms as a powerful proposition.

Click here to view the current GILC brochure (February 2025).

Click here to visit the Global Insurance Law Connect website.

Partner

t: +61 2 9260 2803+61 2 9260 2803

m: +61 408 751 683+61 408 751 683

o: Sydney