Unfair contract terms amendments—substantial penalties and how can you avoid them?

03 October 2023

So far in this series we delved into the broadening scope of the unfair contract terms (UCT) regime, which will soon encompass a much wider array of businesses. We also examined what a “standard form contract” is, and which contract terms might be “unfair”.

In this last article in the series, we look at the new pecuniary penalties for non-compliance and some practical ways you can minimise the risk of contravening the new UCT regime.

As discussed, the new rules are in the Treasury Laws Amendment (More Competition, Better Prices) Act 2022 (Cth) (UCT Amendments) which fortifies the existing UCT regime in the Australian Consumer Law (ACL) and Australian Securities and Investments Commission Act 2001 (Cth). The UCT Amendments become effective on 10 November 2023.

Pecuniary penalties

First thought to be a toothless tiger, the UCT regime is now equipped with a sabre tooth!

Before the UCT Amendments, if a contract term was found to be unfair, the court could only declare that term void and unenforceable. That provided little incentive for compliance.

From 10 November, a person is prohibited from making a contract containing a UCT (if the UCT was proposed by that person) and is also prohibited from applying or relying on (or purporting to apply or rely on) a UCT.

Contravention can result in substantial penalties being imposed. The maximum penalty for a company contravening the new UCT regime is the greatest of:

- $50 million

- three times the value of the "reasonably attributable" benefit obtained from the conduct, (if it can be ascertained by the courts), or

- 30% of adjusted turnover during the breach period (if the benefit is not ascertainable).

If you conduct business as an individual (for example, a sole trader), the maximum penalty could be $2.5 million.

These penalties apply for each contravention, so they could mount up quickly. For example, if your contract contains two unfair terms, your company could be fined up to $100 million.

How do you avoid penalties?

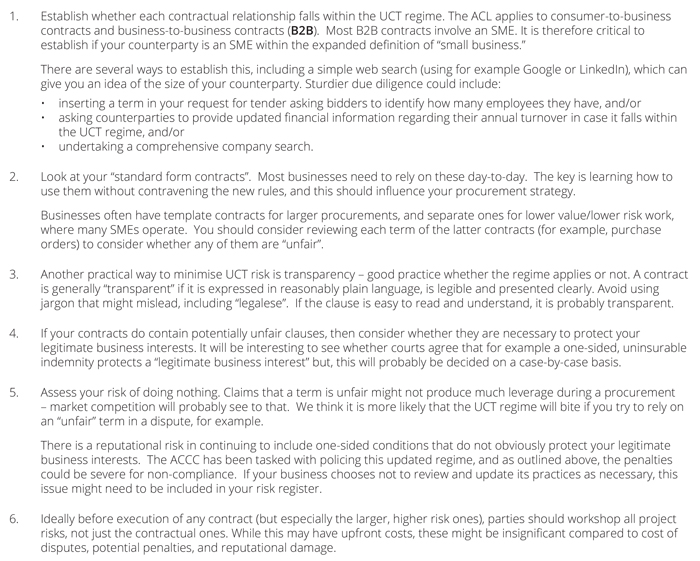

There are several things to consider.

Next steps

The new UCT regime comes into effect on 10 November 2023. Failure to comply with the new regime could put you at risk of large fines and reputational damage; for some businesses, the cost of preventing this might outweigh the risk. Parties should at least have assessed the risks before the new regime applies, so they go into it with eyes open.