Global Insurance Law Connect-D&O global trends report

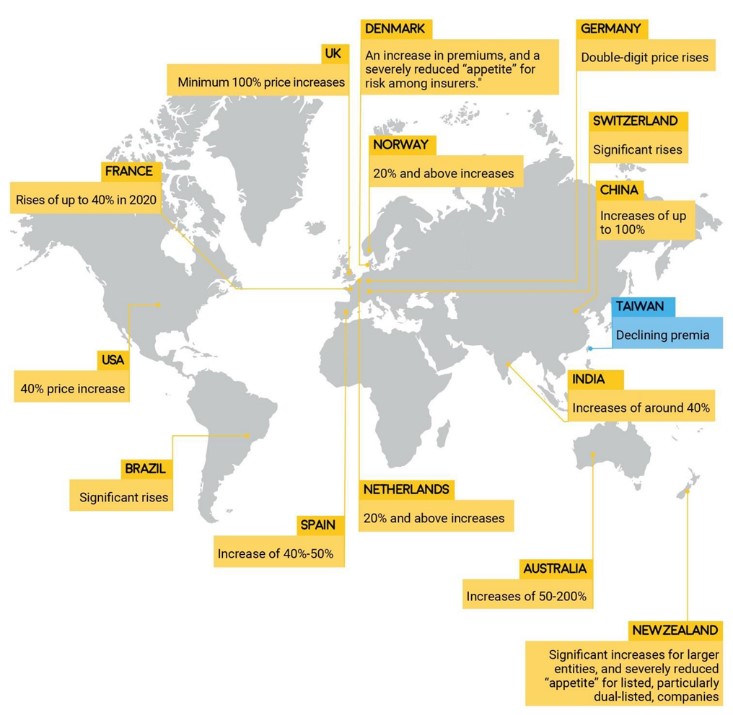

12-November-2021D&O pricing increases 30-100% across the globe

12 November 2021 — Legal network Global Insurance Law Connect (GILC) this week launches its first research report into global D&O markets. The report has had input from insurance lawyers in 20 countries around the globe and its headlines are startling. GILC member firm Sparke Helmore provided the input for Australia.

In many countries, D&O rates are rising, and in some places, those increases are extreme, but this is not the case everywhere. In a few markets the green shoots of recovery are showing as clients reach the limits of what they are prepared to pay, and prices look set to finally stabilise.

Australia is one such country where the price limit has been reached. As Dino Liistro, Sparke Helmore Partner, comments, “The recent experience of underwriters had been that insureds were prepared to increase their spend. The limit may have been reached. Over the last year, insureds began maintaining the same legal spend in the face of rising premiums by increasing excesses or reducing limits of cover and in some cases looking to other risk management solutions to bridge the gap.”

The report also notes other tumultuous global events beyond pricing are impacting D&O including:

-

the global surge in M&A

-

regulatory pressures

-

cyber

-

growth markets

-

environmental and ESG issues, and of course

-

the pandemic.

These issues add up to the increased need for protection for directors and officers, driving up the demand for cover. The report found that while emerging markets in particular have a growing appetite for D&O there is a lack of capacity in many of these markets, with only a small number of insurers operating in the region. European markets also have capacity for growth with some smaller economies showing an upward trend in demand.

Meanwhile in Asia, markets such as China that have fast-growing D&O books have also seen increased securities-related litigation and in India, the basis for D&O claims has widened exponentially.

For Australia, the COVID-19 pandemic appears to have created a volatile and uncertain environment for businesses in a strained D&O insurance market. It is anticipated however that the market will stabilise and soften over the next two years. This optimism is attributed to (now past) increases in premiums together with an apparent slowing of certain types of claims namely, securities related litigation.

Dino Liistro noted, “There has been a decline in securities and insolvency-related investigations and claims over the past 12 months. Early in the pandemic, legislative changes were made in the area of insolvency, and other legislative changes and government support assisted companies. Perhaps because of these actions there has been a decline in corporate insolvencies from pre-pandemic levels, and consequently a decline in insolvency related claims against company directors to now. In the event of insolvencies increasing in the future, of course, we may again see a rise in insolvency related claims.

“Also related to the pandemic, underwriters anticipate further claims in the employment practices liability space—around changing conditions in workplaces—and in respect of policies with an element of crime cover.”

Cyber is another area that continues to be in the spotlight in Australia, as it is around the globe. Underwriters typically consider cyber risk to be covered under D&O insurance policies; to date, there has been very limited claims activity in Australia. Theoretically, a director’s failure to implement reasonable data protection and security controls could ground claims against them. Dino Liistro said, “I anticipate that the risks associated with such claims will grow commensurate with companies’ increasing reliance on technology and data to drive revenues and business operations.”

As Jim Sherwood, Global Chairman of Global Insurance Law Connect, states on the report overall, “The changes of the past decade and recent economic shocks have led to an increased need for protection for directors and officers, in a market that lacks capacity to supply it. The impact has been a notable growth in self-insuring for this class of cover, alongside increased use of letter of indemnity for directors and officers.”

To download the report, visit https://www.globalinsurancelaw.com/2021/11/08/do-global-trends-insurance-capacity-and-pricing/