Australian Government to roll out mandatory climate-related financial disclosure

19 July 2023

Overview

Mandatory reporting is coming!

The Department of the Treasury (Treasury) on 27 June 2023 has provided a further consultation paper for detailed implementation and sequencing of standardised, internationally aligned requirements for mandatory disclosure of climate-related financial risks in Australia. The announcement comes following the release of the International Sustainability Standards Board (ISSB) inaugural global standards – IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 – Climate-related disclosures for sustainability and financial reporting.

The consultation closes 21 July 2023, following which exposure draft legislation will be prepared and legislation introduced to parliament; the intended legislation has a roadmap to commence 2024-25. The Australian Accounting Standards Board (AASB) standards were announced as a separate consult process to be released shortly with detailed disclosure standards to be formally established by the AASB.

In this update we provide a short summary of the details for the proposed changes to the Corporations Act 2001 (Cth) (Corporations Act) and AASB standards in the released consultation paper.

What is the proposed reporting content for climate-related financial disclosure?

Reporting is proposed to be published in the entity’s annual financial reports (director’s report and financial report) under Part 2M.3 of the Corporations Act and may require containment in the operating and financial review (OFR) and formatting requirements.

Timing of the lodgement is proposed to be consistent with s 319 of the Corporations Act and data reporting is suggested to be consistent with the National Greenhouse Energy Reporting (NGER) reporting.

Climate-related disclosure obligations may already exist in circumstances in relation to a prospectus or continuous disclosure announcement. The change would extend to continuous disclosure and fundraising document obligations. There is also proposed an additional requirement to make any climate disclosures publicly available.

The change proposes the annual financial reports to cover the following climate-related financial disclosure from commencement:

- Governance processes to control procedures used to monitor and manage climate-related financial risks and opportunities.

- Climate resilience assessments against at least two possible future states; one must be consistent with the goal in the Climate Change Act 2022 (Cth).

- Use of qualitative scenario analysis to inform disclosures, moving to quantitative scenario analysis by end state.

- Transition plans, including information about offsets, target setting and mitigation strategies.

- Disclosure information about climate-related targets (if any) and progress towards these targets.

- Material climate-related risks and opportunities to their business, as well as how the entity identifies, assesses and manages risk and opportunities.

- Scope 1 and 2 emissions for the reporting period.

- Scope 3 emissions for all reporting entities from their second reporting year onwards for any one-year period that ended up to 12 months prior to the current reporting period.

Which entities will be required to report for climate-related financial disclosure and when?

A three-phased approach will be introduced to the reporting requirements starting with a relatively limited group of very large entities that expands over two years to apply to progressively smaller entities. The phased approach provided by Treasury is outlined in the table below.

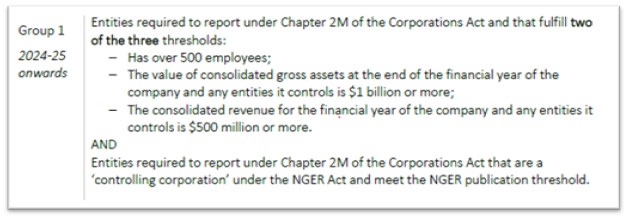

Group one

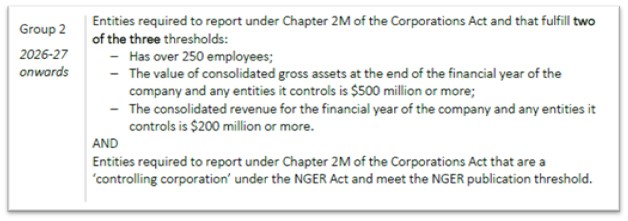

Group two

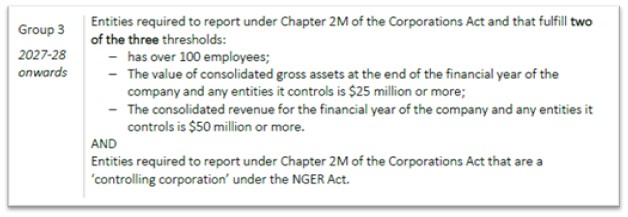

Group three

Credit: Department of the Treasury, ‘Climate-related financial disclosure Consultation Paper June 2023’, accessed 17 July 2023.

NGER entities will also be subject to, where permitted under s 25 of the NGER Act for data to be withheld from publication.

If the Group 3 requirements remain as drafted, this will capture many businesses Three years to set up a compliance system for legislation this far-reaching is not long and those businesses falling into this category will need to be start planning now to be ready for the FY27/28 implementation deadline.

What is the process for the Australian Accounting Standards Board’s climate-related financial disclosure standards?

Further detail about what information would need to be disclosed under the proposed requirements will be set out in forthcoming AASB climate-related financial disclosure standards. As noted above, this will be a separate consultation process.

It is anticipated that there will be alignment with the ISSB benchmark, with Treasury supporting this to minimise compliance costs for entities that operate internationally.

The ISSB is to release further guidance on final standards throughout second half of 2023, with an effective date of 1 January 2024. Treasury is to consult if further revisions occur.

What about assurance?

Assurance providers will be required to be independent from the entity being audited in line with Part 2M.4 and s 307C of the Corporations Act and auditing standards. This is to remove external influence or bias and minimise the risk of conflicts of interest. It is proposed financial auditors supported by technical climate and sustainability experts where required, will lead assurance and this is already becoming a major area of business for the big auditing firms. Treasury’s preferred policy parameters for climate disclosure assurance include:

- to be for limited assurance moving to reasonable assurance over time

- reasonable assurance of scope 3 as a final step in scaling requirements

- provided against the Australian equivalent standards to the ISSB and Corporations Act

- in line with AASB standards, and

- carried out by a qualified and experienced independent provider (conducted or led by the financial auditor).

The CER Register will be available to assist assurance for use of climate-related disclosure audits. Assurance is rolling out under a separate phasing timeline from 2024-25 through to 2030-31.

What will be the liability and enforcement for climate-related disclosure in reporting?

This legislation if implemented will further ratchet up the pressure on directors.

There will be the existing annual report requirements including:

- Directors make a declaration that the financial statements comply with accounting standards, are true and fair, and that the company is solvent.

- Directors exercise the duty of care and diligence (s 180 of the Corporations Act)

- Companies registered schemes and disclosing entities must have the financial report audited and obtain an auditor’s report

The climate-related financial disclosure requirements would be drafted as a civil penalty provision and attract the protection of ss 1317S and 1318 under the Corporations Act. The application of misleading and deceptive conduct provisions to scope 3 emissions and forward-looking statements would be limited to regulator-only actions for a fixed period of three years.

Continuous disclosure requirements would also be introduced for climate-related disclosure intended to fall within the provisions already contained in the Corporations Act.

Elements of mandatory disclosure of Scope 3 reporting, scenario analysis and transition planning are proposed to have time-limited protection from misleading or deceptive conduct, false or misleading representations, and similar claims. This protection will only apply to private litigants, allow ASIC to take action where appropriate and apply for three years from commencement of the regime.

Key Takeaways

Legislative amendments and AASB standards for mandatory climate-related disclosure are being introduced and the proposed rollout is expected to commence in 2024-25 as per the above roadmap. Entities with reporting obligations need to be ready.

ISSB climate-related disclosures are not effective until 1 January 2024, but ISSB permits earlier use as long as IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information is also applied.

Companies should review their operations and assess when they might be captured by this prospective legislation. Smaller companies might consider starting to identify (and perhaps form) the team that will provide the relevant data at the earliest opportunity.

If you are unsure of the regulatory or legislative activities impacting your business or would like assistance in preparing sustainability-related communications, please reach out to one of our experts.