Workplace COVID-19 regular wrap-up - 2 September

02 September 2020JobKeeper 2.0—Legislative update

The JobKeeper 2.0 legislation has now passed Parliament and is extended until 28 March 2021. Only minor technical amendments were made to the Bill introduced last week. Here’s what you need to know:

Eligibility criteria confirmed

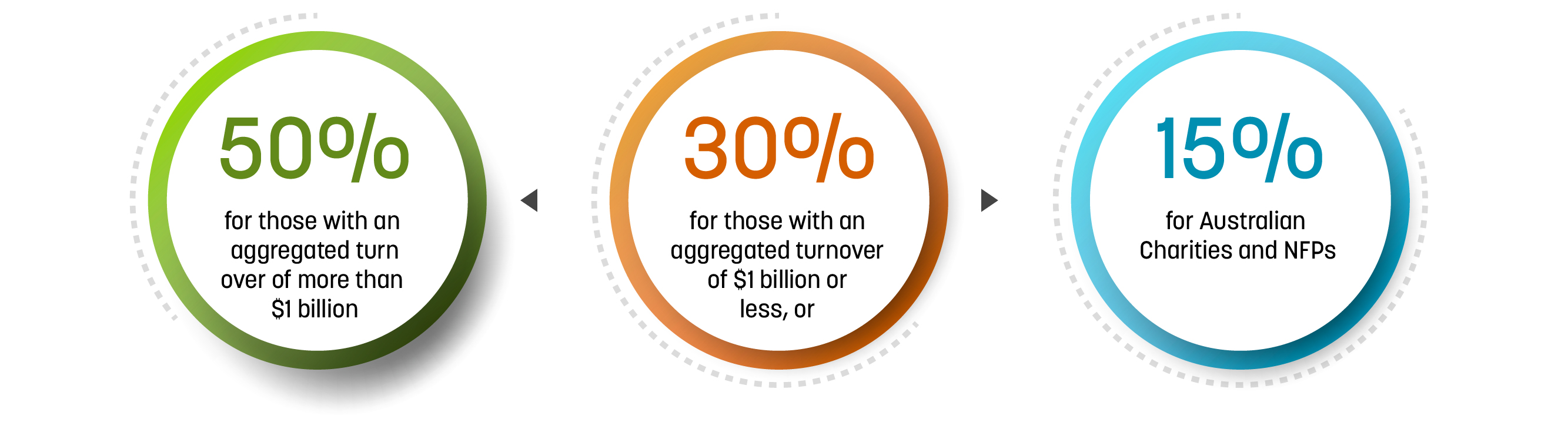

To be eligible for JobKeeper payments after 28 September 2020, businesses (including the self-employed) and NFPs will still need to demonstrate a decline in actual GST turnover for the September quarter 2020 of:

Special rules for “legacy employers”

“Legacy employers” can alter employee working arrangements as if they were continuing to receive JobKeeper payments but:

.jpg)

“Legacy employers” are businesses that have suffered a decline in turnover by 10% or more for the relevant quarter this year compared to last, but do not meet the relevant decline in turnover requirements.

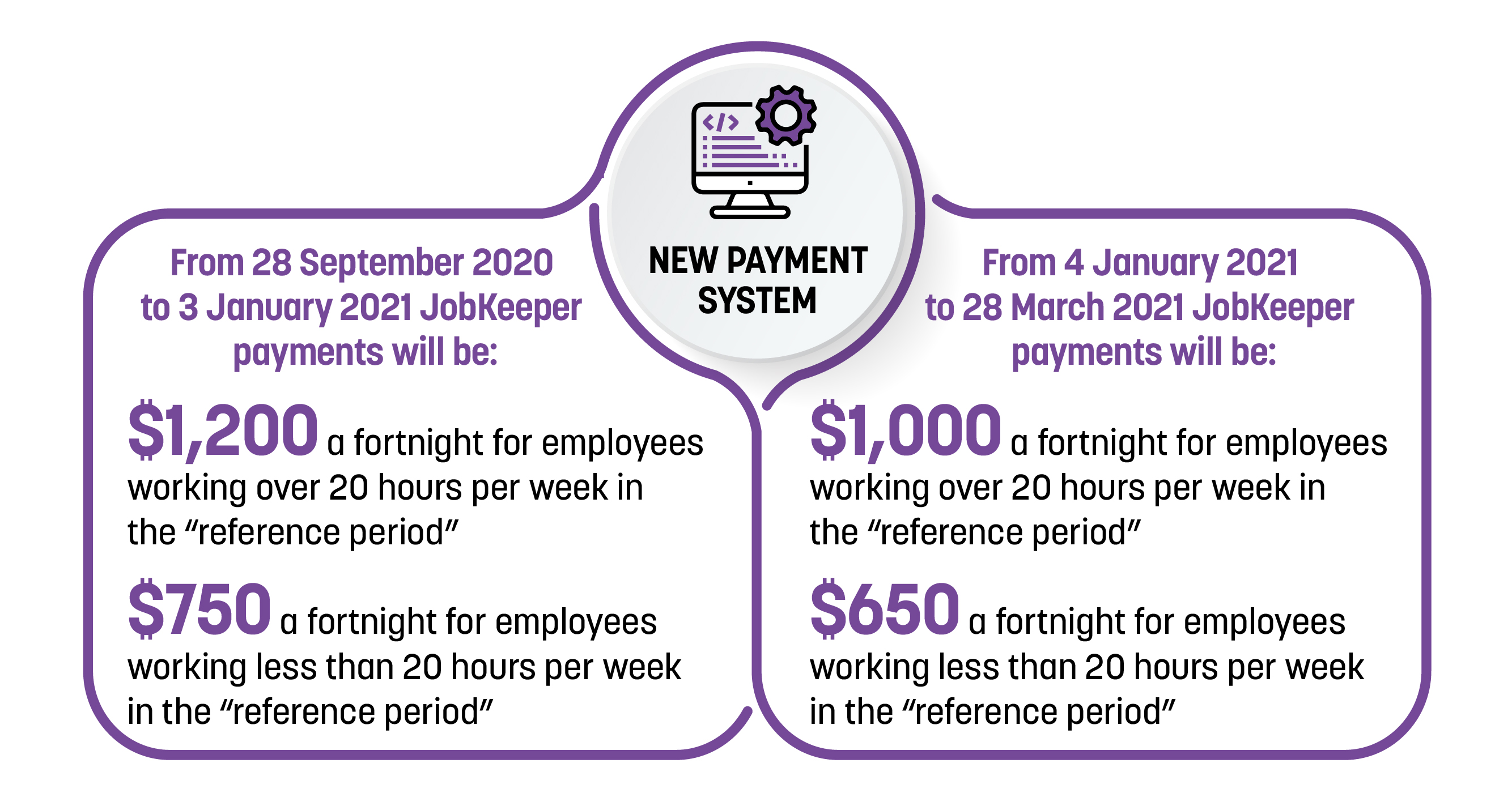

JobKeeper payment system confirmed

The “reference period” for employees will be the two fortnightly pay periods prior to 1 March 2020 or 1 July 2020, whichever is higher.

New penalties apply

Harsh penalties apply to individuals and body corporates who:

- do not meet the 10% decline test but knowingly or recklessly try to use the provisions

- fail to notify employees that a JobKeeper-enabling direction or agreement is continuing or ceasing each quarter.