Navigating the ACCC merger reforms: key changes and transition guidance

12 March 2025

Australia’s merger framework is undergoing significant reform following the Treasury Laws Amendment (Mergers and Acquisitions Reform) Bill 2024 being passed by Parliament on 28 November 2024.

The new regime, set to commence on 1 January 2026, replaces the voluntary system with a new mandatory and suspensory regime. This requires businesses to obtain clearance from the Australian Competition and Consumer Commission (ACCC) for transactions exceeding specified monetary thresholds before they can proceed. Transactions that do not receive ACCC clearance will be deemed void, and parties involved may face substantial penalties.

The ACCC submits that these changes are necessary to prevent anti-competitive mergers in Australia and to ensure competition remains strong across the economy. From 1 July 2025, parties may voluntary notify the ACCC before the mandatory notification requirements and framework comes into effect on 1 January 2026.

Overview

At a high level, the key features of the new merger framework include:

- the new laws apply to notifiable acquisitions of shares, assets or of any other type as described in Part IVA of the Competition and Consumer Act 2010

- it is mandatory for proposed acquisitions that meet the notification thresholds to notify the ACCC

- merger parties must wait for approval from the ACCC before completing the acquisition, and

- the ACCC must make a determination within the specified timeframes.

Key aspects of the new merger regime

Mandatory notification and notification thresholds

The new regime will apply to direct or indirect acquisitions of shares or assets, or any other acquisition deemed notifiable (or exempt) by the Minister following consultation and by legislative instrument, subject to monetary thresholds.

From 1 January 2026, parties must notify the ACCC of acquisitions when:

- there is a ‘change in control’ of a target company that has a material connection to Australia, and

- the transaction meets certain monetary thresholds.

Transactions that are notifiable and meet the specific monetary thresholds cannot proceed without obtaining ACCC clearance.

1. Control test

A key factor in determining whether a transaction is notifiable is whether the acquirer will gain ‘control’ of the target. The definition of control is closely aligned with the definition in the Corporations Act 2001 (Cth) (Corporations Act) and refers to the capacity to determine the outcome of decisions regarding a target’s financial and operating policies.

There is an exemption for acquisitions of shares in the capital of a publicly listed company, listed scheme, or unlisted company with more than 50 members which do not require notification to the ACCC if the acquirer’s voting power does not exceed 20% or does not move from a starting point above 20% to below 100%. This aligns with the takeovers threshold in the Corporations Act.

2. Notification thresholds

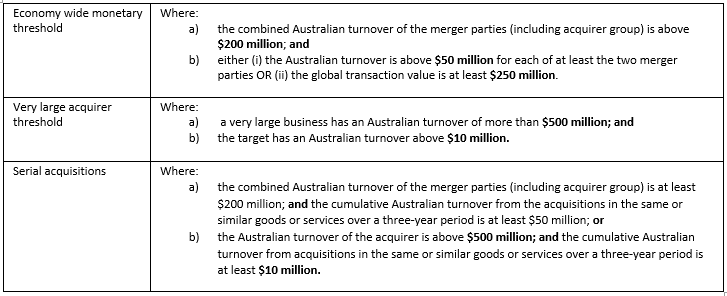

The monetary thresholds have not been finalised; however, the Government has indicted that an acquisition is notifiable if it meets one of the specified monetary criteria and has a material connection to Australia.

The thresholds will be reviewed 12 months after coming into effect.

Serial acquisitions – three- year look back

To capture serial acquisitions, the ACCC can examine the combined effect of the current acquisition and any acquisitions made by the acquirer over the previous three years, regardless of whether those acquisitions were individually notifiable. This approach aims to better handle situations where multiple smaller transactions occur over time, which could collectively harm competition significantly.

Notification waiver

Merger parties may apply for a notification waiver from the ACCC that would relieve their obligation to notify the ACCC of an acquisition. It is proposed that the ACCC would have 30 days to provide a notification waiver; however, the application process remains unclear at this stage.

Designated transactions

The Minister will have the power to designate particular classes of acquisitions that must be notified to the ACCC, regardless of whether they meet the standard monetary or control thresholds. The purpose of this measure is to ensure heightened scrutiny for transactions in high-risk sectors, such as supermarkets and healthcare.

So far, the Minister has announced plans to require mandatory notification for:

- every merger in the supermarket industry

- mergers related to fuel, liquor, and oncology radiology mergers

- interests of 20% or more in private or unlisted companies if one of the parties has a turnover of more than $200 million, and

- childcare, aged care, medical GPs and dentists, which are identified as top four sub-industries for serial acquisitions.

The ACCC as decision maker

The ACCC will serve as the first instance administrative decision-maker, determining whether a merger is likely to substantially lessen competition and deciding whether to grant clearance. If any parties disagree with the ACCC’s decision, they can seek a review from the Australian Competition Tribunal, which will replace the Federal Court of Australia as the primary review body for mergers.

Timeframe for review

The timeframes for the ACCC to make a determination on transactions are as follows:

- Phase 1 determination: the ACCC will make a determination within 30 business days after the effective notification date. If no issues are identified, a ‘fast track’ determination may be possible after 15 business days.

- Phase 2 determination: if competition concerns are identified and the ACCC is satisfied that the acquisition could have the effect or likely effect of substantially lessening competition, a Phase 2 review will commence. This review will last up to 90 business days after the Phase 1 period ends.

Fees

Filing fees for merger notifications will range from $50,000 to $100,000, based on the complexity and risk of the transaction. Exemptions from fees may be available for small businesses.

Public register

The ACCC will maintain a public register to enhance transparency in merger reviews. The register will publish a list of all notified acquisitions. Additionally, the ACCC will provide reasoning behind its final determinations for all notified acquisitions. For Phase 2 reviews, the ACCC will issue and publish a Notice of Competition Concerns, excluding confidential information, to inform stakeholders and allow merger parties to respond.

ACCC guidance on transitional arrangements

On 4 March 2025, the ACCC released guidance on transitional arrangements to assist businesses and advisers in managing the transition to the new mandatory and suspensory merger control regime.

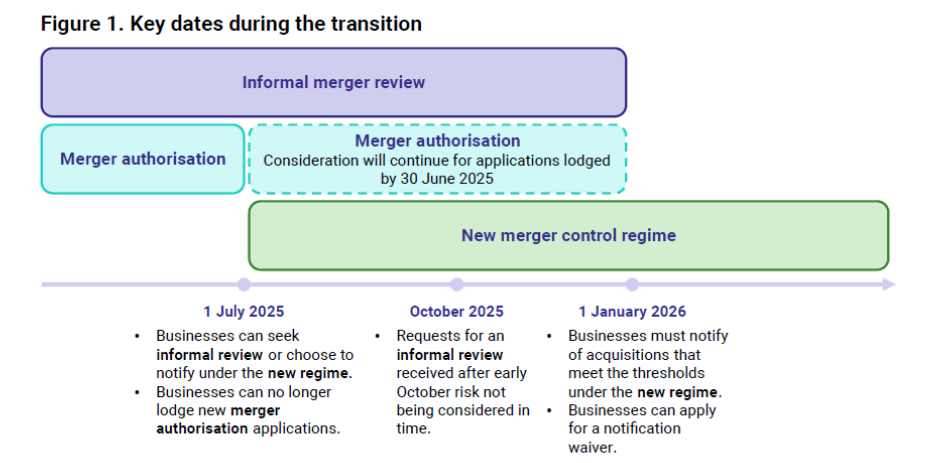

The ACCC has provided the key dates in the timeline in Figure 1 below.

Between now and 1 July 2025 (before voluntary notification becomes available)

From now until 1 July 2025, parties can voluntarily seek clearance from the ACCC under the existing informal merger review or a formal merger authorisation.

The informal merger review process allows the merger parties to seek the ACCC’s view on whether their proposed acquisition is likely to ‘substantially lessen competition’. A ‘substantial lessening of competition’ refers to mergers or acquisitions that create, strengthen, or entrench a substantial degree of market power, reducing competitive constraints in a market.

If the ACCC forms the view that the acquisition is unlikely to ‘substantially lessen competition’, the merger parties will be advised that no further action is required, and the acquisition may proceed. It is important to note that, unlike the formal merger authorisation process, the informal merger review does not protect merger parties from potential legal action by the ACCC or other parties.

The formal merger authorisation is a formal public process that enables merger parties to apply to the ACCC to confirm that the acquisition is unlikely to substantially lessen competition or because it will result in a net public benefit. If the ACCC grants the authorisation, the merger parties can continue with the acquisition without the risk of legal action from the ACCC due to competition concerns.

From 1 July 2025 to 31 December 2025 (transition period where parties can voluntarily notify the ACCC)

During this period, merger parties have two options when engaging with the ACCC:

- continue with the current regime (either an informal merger review or formal merger authorisation), or

- use the new regime on a voluntary basis.

The ACCC emphasises that merger parties choosing to use the informal merger review process must engage with the ACCC as soon as possible to avoid running out of time before the new mandatory regime takes effect on 1 January 2026. Requests for reviews submitted between October 2025 and December 2025 are unlikely to be considered in time, so parties should consider lodging a voluntary notification under the new regime.

Applications for merger authorisations cannot be accepted after 30 June 2025. If the ACCC grants merger authorisation between 1 July and 31 December 2025, merger parties will not need to re-notify the ACCC under the new regime, provided the acquisition is put into effect within 12 months of the merger authorisation.

Any decisions not made by the ACCC by 30 December 2025 will be listed as having ‘no decision’, and merger parties will be required to re-notify the ACCC under the new regime.

From 1 January 2026 onwards (commencement of new mandatory notification regime)

The current voluntary regime becomes void, and merger parties must comply with the new mandatory regime. This means that parties must notify acquisitions that meet the notification thresholds and must obtain ACCC clearance on the transaction (unless a waiver is obtained or they are otherwise exempt).