Franchising reforms for 2025

31 March 2025

The Treasury has recently released a new Franchising Code of Conduct to regulate the conduct between franchisors and franchisees, both actual and prospective, and the franchise agreements that govern franchise arrangements. The Competition and Consumer (Industry Codes - Franchising) Regulation 2024 (New Code) will replace the current Competition and Consumer (Industry Codes – Franchising) Regulation 2014 (Current Code). The New Code aims to address the power imbalance between franchisors and franchisees, improve the standards of conduct in the industry and provide fair dispute resolution procedures.

The overhaul has significantly increased the compliance and risk for franchisors. Accordingly, franchisors must ensure their franchise agreements and Disclosure Documents meet the requirements under the New Code to avoid significant penalties.

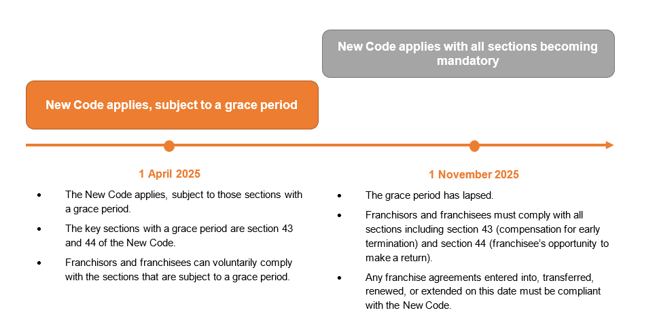

When does the New Code apply?

The New Code applies to all franchise agreements entered into, renewed, extended, or transferred on or after 1 April 2025.

Existing franchise agreements entered prior to 1 April 2025 will continue to be regulated under the Current Code until those agreements are altered as above, in which case the New Code will apply.

Whilst some of the changes under the New Code have a grace period until 31 October 2025 (see below), franchisors are encouraged to ensure their existing franchise agreements are compliant with the New Code as soon as possible.

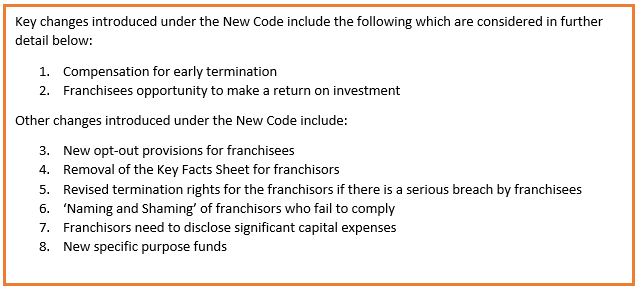

What are the key changes?

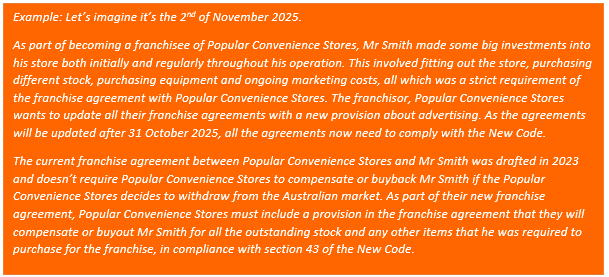

1. Franchisor to provide compensation for Early Termination

One of the most important changes is s 43 of the New Code. The section now requires franchise agreements to include a provision requiring the franchisor to compensate or buyback the franchisee (which may include buying back stock, equipment, products, or other items) if the franchisor:

- withdraws from the Australian market

- rationalises its networks in Australia, or

- changes its distribution models in Australia.

The franchise agreement must specify how the franchisee will be compensated and must include specific reference to lost profit from direct or indirect revenue, unamortised capital expenditure requested by franchisors, loss of opportunity in selling established goodwill and the costs of winding up the franchised business.

It is important that franchisors include a provision for compensation for early termination in any franchise agreements entered into, renewed, or extended on or after 1 November 2025. Any failure by the franchisor to comply with this requirement may impose a civil penalty of up to 600 units, being $198,000 (as of March 2025).

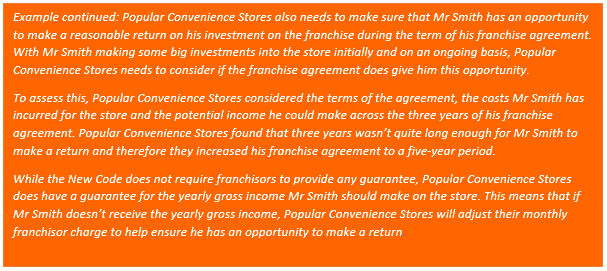

2. Franchisee’s reasonable opportunity to make a return on investment

The second significant change to the New Code is the addition of s 44. The New Code now requires that franchisees have a reasonable opportunity to make a return on any investment required by the franchisor when the franchisee entered into the agreement. This opportunity to make a return must occur across the term of the agreement and includes any initial and ongoing investments provided by the franchisee.

There is no minimum profit percentage to dictate what may constitute a return on investment and the Minister has emphasised that the clause does not require franchisors to provide a contractual guarantee of a profit or actual success to the franchisee. Instead, the Minister has said the provision aims “to ensure that the term of the franchise agreement is consistent with the level of capital investment” by the franchisee. To determine what is a reasonable opportunity to achieve a return, the Minister has said franchisors should assess “the terms of each agreement, the costs paid by the franchisee and the length of the agreement”.

The provision reflects the need for franchisors to enter into an agreement in good faith, which is a current obligation that franchisors should be already compliant with.

It is important that franchisors commercially assess whether there would be a reasonable opportunity for a franchisee to make a return before entering into, renewing, extending, or transferring any franchise agreements with existing and prospective franchisees on or after 1 November 2025. A failure to do so may incur penalties of up to 600 units, being $198,000 (as of March 2025).

Other changes

3. Opt-out

Under s 23 of the New Code, if a franchisee is seeking to enter into another franchise agreement or a new franchise agreement with their existing franchisor, the franchisee can now opt-out of receiving the Disclosure Document and a copy of the New Code which will reduce the administrative burden on franchisors.

Franchisees can also opt-out of the mandatory 14 day cooling off period when entering into a franchising agreement if they have, or recently had, another franchise agreement with the franchisor that is the same or substantially similar to their existing agreement. To ensure franchisees still have protection, franchisees must provide notice of their choice to opt-out in writing and the franchisee maintains the ability to request the Disclosure Document at any time. This provision will come into effect on 1 April 2025.

4. Key Facts Sheet

To further reduce the administrative burden, the New Code has removed the requirement on franchisors to create, maintain or provide a Key Facts Sheet for prospective franchisees from 1 April 2025. A franchisor will also no longer be required to upload a Key Facts Sheet or a Disclosure Document to the Franchise Disclosure Register. All previously uploaded Documents will no longer be publicly viewable from 1 April 2025.

5. Termination for serious breach

Under the New Code, if a franchisee is found to have engaged in serious misconduct, a franchisor may provide 7 days’ notice to terminate the franchise agreement. If this occurs, alternative dispute resolution will not be available for franchisees. This section does not prevent a franchisor from providing a franchisee with more time to address a ground for termination if they wish to do so. This provision will come into effect on 1 April 2025.

6. ‘Name and Shame’

The New Code has given the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) the power to publicly name franchisors who fail to meaningfully engage in, or who withdraw from, alternative dispute resolution with a franchisee. The ASBFEO can publish, in any way it thinks appropriate, to draw attention to the behaviour of the franchisor. This will come into effect on 1 April 2025.

7. Disclosing significant capital expenses

Franchisors must now ensure that the Disclosure Statement includes details about whether the franchisee will be required to undertake significant capital expenditure during the term of the franchise agreement. If so, the franchisor must include the rationale, amount, timing and nature of expenditure, anticipated outcomes and benefits and expected risks. This will come into effect on 1 November 2025.

8. Specific purpose fund

Marketing and cooperative funds are now redefined as a ‘specific purpose fund’. This is intended to capture any money used for a specific purpose under the agreement and will extend beyond marketing to also include conference and IT funds. It is essential that franchisors comply with the new fund to avoid penalties, potential claims by the ACCC or claims by franchisees. This will come into effect on 1 November 2025.

Key takeaways

As you can see, the New Code will introduce changes that significantly affect both franchisors and franchisees. In particular, franchisors will need to ensure that any new franchise agreements entered into, renewed or extended on or after 1 November 2025 are compliant to minimise any risk of penalties or adverse actions being taken against the franchisor.