Closing Loopholes Part 1 - Commonwealth Wage Theft Laws

22 January 2024

On 7 December 2023, the Commonwealth Parliament passed Part 1 of its ‘Closing Loopholes’ amendments into law via the Fair Work Legislation Amendment (Closing Loopholes) Act 2023 (Cth).

Amongst the changes introduced was the new Commonwealth offence of Wage Theft. This offence does not apply retrospectively and only applies to Wage Theft offences committed from 1 January 2025.

In essence, the Fair Work Ombudsman (FWO) now has available to it the option of pursuing a criminal prosecution for the most serious forms of intentional underpayment, with the largest penalties that may be imposed for any employment-related non-compliance being available (nearly $3 million for body corporates and up to 10 years in prison for individuals). Employers and senior managers should be mindful that if they are involved in underpayments, they could be facing serious criminal penalties if the conduct is determined to be intentional. Inadvertent or unintended underpayments are not captured by the new laws.

What is ‘Wage Theft’?

An employer commits the criminal offence of Wage Theft if:[1]

- an employer is required to pay an amount[2] to (or on behalf of) an employee (whether under the Fair Work Act 2009 (Cth) (FW Act) or an industrial instrument (e.g. modern award, enterprise agreement) (Required Amount)

- the employer engages in conduct, and

- this conduct results in a failure to pay the Required Amount “in full” on or before the day it is due for payment.

In order to establish the second and third elements of the Wage Theft offence, the fault element of intention must be proven. That is:[3]

- the employer has intention with respect to conduct if it meant to engage in the conduct

- the employer has intention with respect to a circumstance if it believed that a circumstance exists or will exist, and

- the employer has intention with respect to a result if it meant to bring it about or is aware that it will occur in the ordinary course of events.

Practically, this means that the offence will not capture inadvertent or unintentional underpayments. The employer must have intended not to pay the Required Amount in full when it was due or knew that this is what would occur in the ordinary course of events.

In assessing intent for a body corporate, it will need to be shown that the body corporate expressly, tacitly, or impliedly authorised or permitted the commission of the offence. Such authorisation or permission can be established by proving that:[4]

- the body corporate's board of directors[5] intentionally or knowingly carried out the relevant conduct, or expressly, tacitly or impliedly authorised or permitted the commission of the offence

- a high managerial agent[6] of the body corporate intentionally, knowingly, or recklessly engaged in the relevant conduct, or expressly, tacitly or impliedly authorised or permitted the commission of the offence[7]

- a corporate culture[8] existed within the body corporate that directed, encouraged, tolerated, or led to non-compliance with the relevant provision, or

- the body corporate failed to create and maintain a corporate culture that required compliance with the relevant provision.

Who can be charged with Wage Theft?

A Wage Theft offence can only be committed by an employer (being a national system employer under the FW Act). This can either be a body corporate or a natural person depending on the particular business structure used by the employer.

Additionally, under the Criminal Code 1995 (Cth) a person who aids, abets, counsels, or procures the commission of an offence by another person is taken to have committed that offence and is punishable accordingly.[9] This is applicable to Wage Theft offences as well, meaning that individuals who are involved in the commission of Wage Theft offences may themselves be charged under this provision.

The Minister will be required to create a Voluntary Small Business Wage Compliance Code (Code). If a small business employer (i.e. a business with less than 15 employees) complies with the Code to the satisfaction of the FWO, then the FWO must not refer the matter for a possible prosecution for Wage Theft. This does not, however, prohibit the FWO from commencing civil penalty prosecutions.

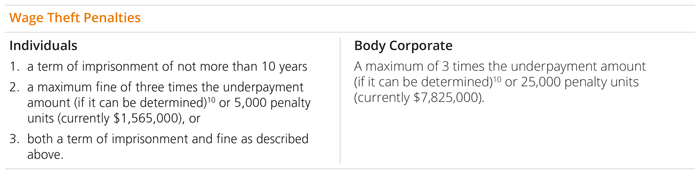

What are the potential penalties?

The value of the underpayment amount is the difference between the Required Amount and the amount the employer actually paid to, or on behalf of, the employee in relation to the Required Amount.

There are also provisions under which offences are aggregated where they arise from a single course of conduct, meaning that a single penalty may only be imposed for multiple offences in some circumstances.

What are ‘Cooperation Agreements’?

The FWO has now been given the power to enter into ‘Cooperation Agreements’ with persons who have possibly committed Wage Theft. If a Cooperation Agreement is entered into between the FWO and a person, the FWO is prohibited from referring the conduct covered by that agreement to the Commonwealth Director of Public Prosecutions (DPP) or the Australian Federal Police (AFP) for consideration of a criminal prosecution. A Cooperation Agreement only relates to criminal offences, it does not prohibit the FWO from commencing civil remedy proceedings against any party to the Cooperation Agreement.

In determining whether to enter into a Cooperation Agreement, the FWO must have regard to the scope and detail of any voluntary disclosures, the participating persons cooperation with the FWO, the FWO’s assessment of the person’s commitment to continued cooperation, the nature and gravity of any conduct, the circumstances in which the conduct occurred and the person’s history of compliance.

In essence, the Cooperation Agreement is analogous to the Enforceable Undertakings currently used by the FWO in civil penalty proceedings, but they only relate to resolving the issue of criminal liability. The Cooperation Agreements may also be used by the FWO to secure the cooperation of individuals who might be privy to evidence that would assist in proving Wage Theft offences against an employer or senior director of an employer in a manner not dissimilar to immunity agreements used by other regulators such as the ACCC.

How will Wage Theft be investigated and prosecuted?

The FWO will have responsibility for investigating Wage Theft offences. The FWO’s powers relating to obtaining information and documents have been amended such that employee records that are produced by individuals (i.e. not body corporates) to the FWO in response to its compulsive powers no longer gain derivative use immunity (i.e. employment records obtained in a FWO investigation via the FWO’s use of its powers can now be used against an employer as evidence of a criminal offence).

Prosecutions for Wage Theft must be commenced within six years after the commission of the offence and can only be commenced by either the DPP or AFP. The Federal Court has been granted the jurisdiction to hear Wage Theft cases. As they are indicatable offences, they will only be triable by jury.

[1] There are certain exceptions applicable to this offence relating to certain police officers and office holders covered by sections 30C, 30D, 30M and 30N of the Fair Work Act 2009 (Cth). However, these exceptions are unlikely to have application to the majority of employers.

[2] This includes superannuation, long service leave and other leave entitlements.

[3] See Criminal Code 1995 (Cth), section 5.2.

[4] Criminal Code 1995 (Cth), section 12.3.

[5] "board of directors" means the body (by whatever name called) exercising the executive authority of the body corporate.

[6] "high managerial agent" means an employee, agent or officer of the body corporate with duties of such responsibility that his or her conduct may fairly be assumed to represent the body corporate's policy.

[7] It is a defence to proving this element if a company can show that it exercised due diligence to prevent the conduct, authorisation or permission: Criminal Code 1995 (Cth), section 12.3(3).

[8] "corporate culture" means an attitude, policy, rule, course of conduct or practice existing within the body corporate generally or in the part of the body corporate in which the relevant activities takes place.

[9] Criminal Code 1995 (Cth), section 11.2.

[10] If the underpayment amount cannot be determined than the penalty unit value is simply applied.