A New Era for Victorian Stamp Duty and Taxes on Commercial and Industrial Property: The CIPT Act Explained

31 May 2024

The much anticipated Commercial and Industrial Property Tax Reform Act 2024 (Vic) (CIPT Act) received royal assent on 20 May 2024. The CIPT Act abolishes stamp duty on dutiable transactions relating to commercial and industrial land, introduces in its place, a commercial and industrial property tax (CIPT) chargeable annually.

This article is an overview of the changes proposed by the CIPT Act.

The CIPT Act reforms will apply on and from 1 July 2024 (Start Date).

What land does the CIPT Act apply to?

The CIPT Act applies to land that has a qualifying use within commercial and industrial use categories under the Australian Valuation Property Classification Code (AVPCC) and certain student accommodation.

If a land has multiple uses, the CIPT Act will apply if a property’s ‘sole or primary’ use has a qualifying use as commercial, industrial or eligible student accommodation.

What transactions involving qualifying land does the CIPT Act apply to?

The CIPT Act will be triggered to apply to qualifying land if any of the following circumstances occur after the Start Date:

- (Entry Transaction) A dutiable acquisition of at least a 50% (either in one transaction or in multiple transactions per aggregation rules) interest in land or a landholding entity

- (Entry Subdivision) Subdivisions where child titles are used for a qualifying use, or

- (Entry Consolidation) Consolidations where at least 50% of the consolidated area comprises qualifying land.

The Entry Date is the date of the first of the above to occur.

At the Entry Date, the land becomes subject to the CIPT Act (Subject Land).

What is the result of land becoming subject to the CIPT Act

If qualifying land becomes Subject Land as a result of an Entry Transaction, a purchaser must pay the ‘final’ stamp duty that is payable on the relevant interest acquired on the Subject Land, calculated on the prevailing rates on the dutiable value of that Entry Transaction.

Stamp duty may be paid up front or, if the purchaser qualifies, via a government facilitated transition loan with a 10-year repayment term.

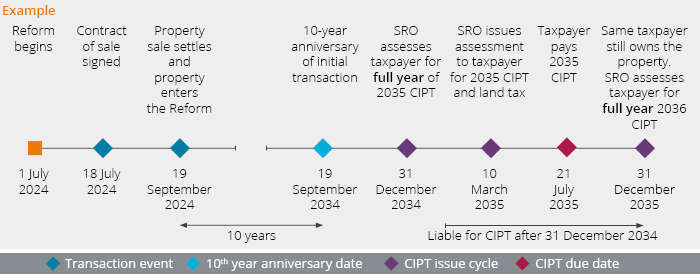

The CIPT will be levied on the Subject Land on the expiry of 10 years after the Entry Date. CIPT is charged at 1% per annum on the unimproved land value of the Subject Land (without a tax-free threshold). Land used for build-to-rent developments will be charged at a rate of 0.5% per annum. The unimproved land value may be subject to revaluation undertaken by the Commissioner of State Revenue (in the same manner where unimproved land value may be revalued for purposes of land tax).

Subsequent transactions of Subject Land will no longer be subject to stamp duty to the extent the Subject Land remains qualifying land but the CIPT will continue to be payable in respect of the Subject Land.

Image source: Department of Treasury and Finance Victoria, Commercial and Industrial Property Tax Reform

Who is eligible for a government facilitated loan to assist purchasers to pay stamp duty?

Eligibility criteria for a transition loan are yet to be confirmed but recent non-binding guidance notes indicate that Australian residents who purchase an interest in land with a price under $30 million may be eligible for transition loan.

The legislation makes it clear that there is no obligation for the government to provide a transition loan even if a purchaser is eligible for a transition loan.

Transition loans cannot be novated or assigned, therefore a borrower must repay the balance of the transition loan in the event of a subsequent sale of the Subject Land, or when a change of use applies.

If granted, a transition loan will be secured by a first ranking registered statutory charge over the Subject Land.

What special rules apply to Entry Transactions of fractional interests?

If an Entry Transaction relates to a fractional interest in land, further stamp duty may be payable in relation to subsequent transactions of the remaining fractional interests in that land, if the transacted within three years of the Entry Transaction.

For example: If Company A purchases 60% of shares of a company which owns qualifying land (Landholder Co), Company A pays stamp duty in relation to that acquisition. The land owned by Landholder Co will become Subject Land. If Company B purchases the remaining 40% of the shares in Landholder Co (not owned by Company A) within three years, Company B must pay stamp duty on that acquisition. If, however Company B purchases 40% of shares of Landholder Co owned by Company A, no stamp duty is payable.

What transactions are exempted?

Some exemptions apply to land being subject to the CIPT Act such as:

- the grant, transfer or assignment of a dutiable lease

- the acquisition of an economic entitlement

- a dutiable transaction that is eligible for an exemption from stamp duty, and

- a dutiable transaction that is eligible for the corporate reconstruction or corporate consolidation concession.

Does CIPT Replace land tax?

No, CIPT applies in addition to land tax. However, if a land is exempt from land tax, it will also be exempt from CIPT (e.g., land used exclusively for charitable purposes, sporting, recreational and cultural land that are currently exempt from land tax).

When does liability for CIPT cease?

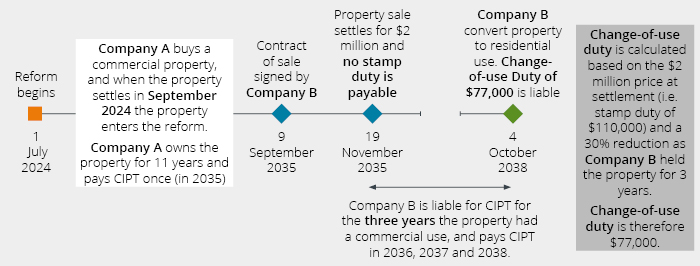

Owners of Subject Land are liable to pay the CIPT until the year after a change of use occurs in relation to that Subject Land to a non-qualifying use (e.g., upon development of commercial land into residential land).

If a change of use as described above occurs without a change of ownership, then stamp duty will be payable on subsequent transactions of that land.

If a purchaser purchases Subject Land (without being required to pay stamp duty) and subsequently converts the Subject Land to a non-qualifying use within 10 years of that purchase, it is liable to pay ‘change-of-use’ duty, calculated based on the stamp duty that would have been payable when the Subject Land was transacted, including any relevant concessions, but reduced by 10 per cent for every 31 December that has passed since that transaction, to a maximum of 100 per cent.

Image source: Department of Treasury and Finance Victoria, Commercial and Industrial Property Tax Reform

What are the key considerations for landowners?

- Landowners must consider circumstances where a subdivision or consolidation may result in the land becoming Subject Land and the relevant Entry Date.

- Landowners must consider circumstances where a transaction of a fractional interest in qualifying land would result in the land becoming Subject Land (either by acquiring at least a 50% interest in qualifying land via one or more transactions per aggregation rules), and the relevant Entry Date.

- If a landowner owns Subject Land, they may be able to pass on CIPT liability under commercial or industrial leases, but not under a lease of retail premises (as defined in the Retail Leases Act 2003 (Vic)).

- If a landowner intends to sell qualifying land, it should consider that a two-tier market may come into existence, one for Subject Land and another for non-Subject Land.

- If a landowner intends to dispose of qualifying land it is required to disclose in a vendor statement prepared pursuant to the Sale of Land Act 1962 (Vic) the qualifying land’s most recent qualifying use, whether or not the land is Subject Land, and if it is, the Entry Date.

- A landowner cannot seek to recover or adjust CIPT paid on Subject Land to the extent the Property Law Act 1958 (Vic) prohibits recovery or adjustment of land tax on a contract of sale. Currently, contracts of sale with a sale price of under $10 million is subject to this prohibition.

What are the key considerations for purchasers?

- Purchasers should consider whether a proposed acquisition of a fractional interest in qualifying land would result in the land becoming Subject Land (either by acquiring at least a 50% interest in qualifying land via one or more transactions per aggregation rules) and the Entry Date.

- Purchasers who intend to purchase qualifying land which is not yet Subject Land as a long term investment should consider the implications of having to pay ‘final’ stamp duty on that acquisition, and subsequently the CIPT.

- Purchasers may find transacting to purchase an interest in Subject Land more attractive as they can be generally transacted without stamp duty when compared to non-Subject Land.

- Purchasers in undertaking due diligence on Subject Land should consider the ability to pass-through any CIPT liability to tenants.

While in concept the CIPT Act is simple at a high level, there is likely to be considerable difficulty and uncertainty in its practical application, especially in relation to transactions involving fractional interests in the land and subsequent changes of use.

If you have any questions regarding any future acquisitions or disposals of commercial or industrial properties, or currently owned properties that may be impacted by these reforms, please do not hesitate to contact one of our team.