Commercial and retail leases: why and how lease dealings should be registered on title

04 May 2023

We would like to acknowledge the contribution of Sidney Landis.

Why leases should be registered

In short, registering a lease creates a legal interest in the land for a tenant, meaning the tenant’s interest under the lease will be afforded protection from dealings affecting the title to the land. For instance, if the landlord sells/transfers the land that has a registered lease on title, the purchaser/transferee of the land would be on notice of, and be bound by, the lease terms.

The law

Section 53 of the Real Property Act 1900 (NSW) (the RP Act) provides that when land under the RP Act is leased for a term exceeding three years (including the initial term and any option terms), the lease must be in the ‘approved form’.

Further, s 42(1)(d) of RP Act provides that a lease with a term exceeding three years must be registered on title for the lease to pass with the land if the land is transferred/sold.

However, neither ss 53 nor 42 of the RPA mandate the registration of a lease. Section 42 merely provides that unregistered leases with a term exceeding three years do not pass with land.

Leases with a term not exceeding three years (i.e., up to and including three years—including any option(s) to renew)—are provided statutory protection and are not required to be registered, although the parties may still choose to do so.

By contrast, s 16 of the Retail Leases Act 1994 (NSW) (the Retail Act) provides that any lease that falls within the scope of the Retail Act and which has a term exceeding three years (including any option(s) to renew) must be registered. Failure to comply with the Retail Act can incur penalties.

Consequence of non-registration

If a lease is not registered, any competing registered interest over the title will take preference.

Practically, the biggest concern for a tenant will most often be that if the landlord sells the land and the lease is for a term exceeding three years and not registered on title, the purchaser of the land would not be bound by the unregistered lease and the tenant could be forced to vacate.

While lease registration costs are typically payable by a tenant, the cost is minimal (NSW Land Registry Services’ (LRS) fee is currently $154.20) compared to the potential legal costs and practical issues that can arise if the lease is not registered.

How leases are registered

Since 11 October 2021, NSW abolished physical Certificates of Title and has since moved to 100% mandatory electronic conveyancing. LRS no longer accepts, nor does it issue new, Certificates of Title.

As a result of this, lease dealings (including lease, sublease, variation of leases, surrender of lease and transfer of lease) must be registered via an Electronic Lodgment Network Operator (ELNO). At the moment, the most commonly used ELNO is Property Exchange Australia (PEXA).

Only certain entities are capable of being subscribers to PEXA, meaning that individuals will usually need to engage a Licensed Conveyancer or an Australian Legal Practitioner to act on their behalf for the purposes of registration.

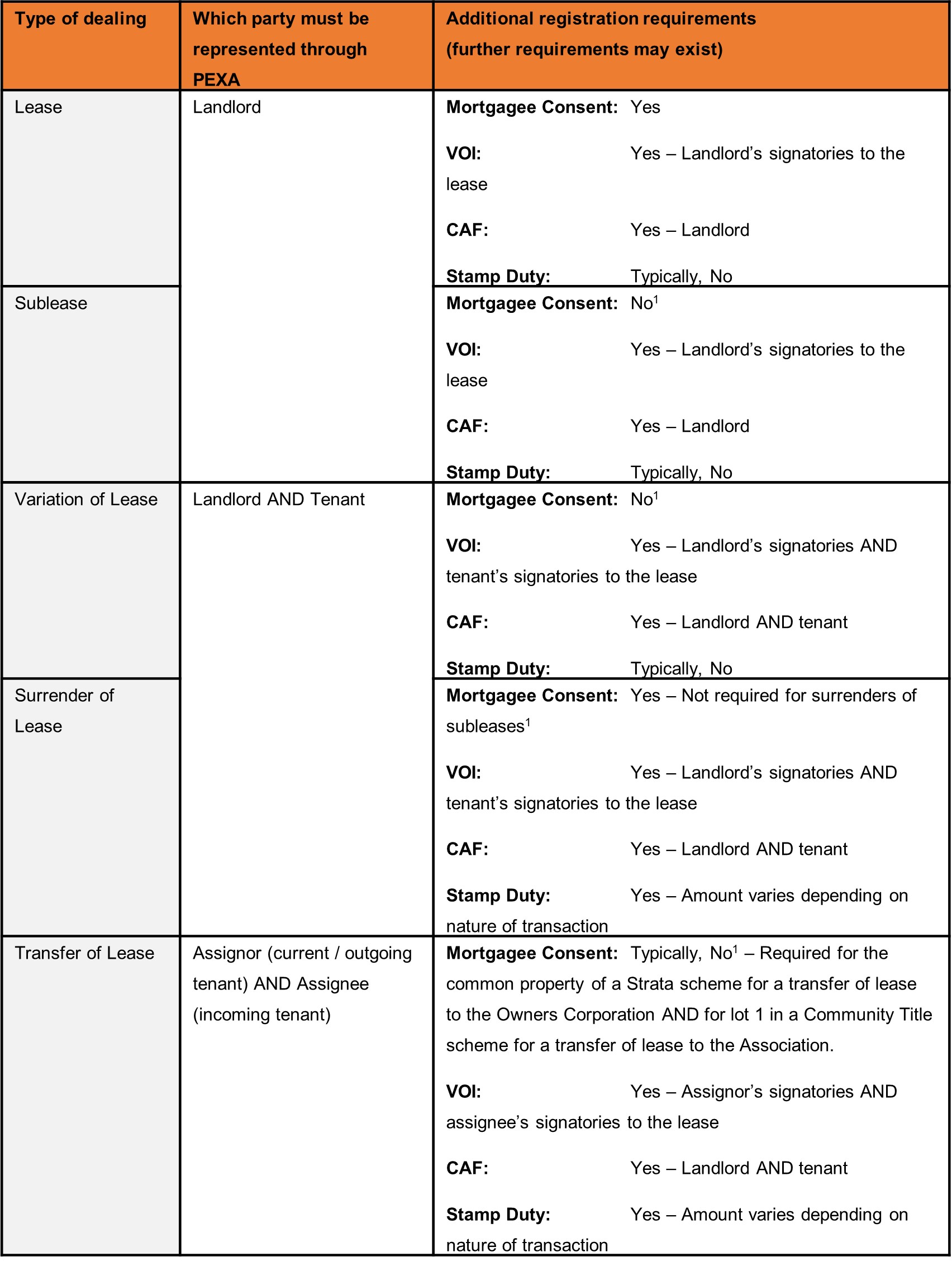

The following table provides a high level overview of the requirements (as at the date of this article) to register lease dealings via PEXA:

While certain leases are afforded statutory protection and do not require registration, any lease whether commercial or retail that has a term exceeding three years (including any option term(s)), should be registered on title to the landlord’s property to create a legal interest in the land for the tenant.

If you have any queries or require legal assistance with your commercial and/or retail leasing matters, please don’t hesitate to contact us.

1 While mortgagee consent may not be required for the purposes of registration at LRS, consent may still be required pursuant to the specific terms of the mortgage.