Building Legislation Amendment (Buyer Protections) Act 2025 – A step towards stronger consumer protection and industry accountability

17 September 2025

The long-anticipated Building Legislation Amendment (Buyer Protections) Act 2025 (the Act) has now received royal assent. This is the final instalment in our three-part series.

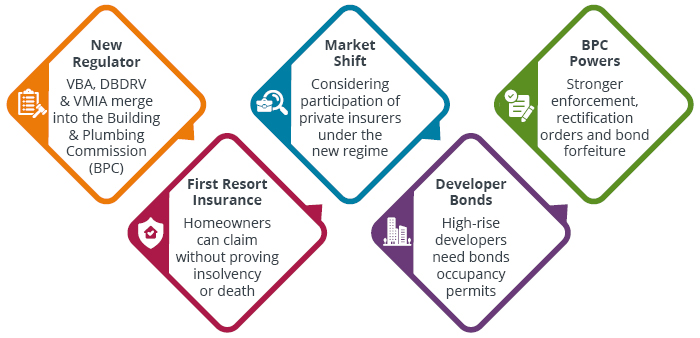

The five key takeaways from the Act are:

A single industry regulator: the BPC

From 1 July 2026 (or earlier if proclaimed), the newly formed Building And Plumbing Commission (BPC) will assume the functions of the Victorian Building Authority (VBA), the Domestic Building Dispute Resolution Victoria (DBDRV), and the Victorian Managed Insurance Authority (VMIA). Unlike its predecessors, the BPC has adopted a more assertive approach, with over 60 prosecutions against building practitioners currently underway, marking the highest in in Victoria’s history.

This shift reflects a broader cultural change toward enforcement and accountability. The BPC Commissioner Anna Cronin has described this shift as putting ’consumer protection on steroids.’ Numerous contemporary examples of homeowners left with incomplete and non-compliant homes highlight the real-world consequences of regulatory failures and the urgent need for reform.

A similar structural model exists in New South Wales, where the Building Commission NSW (the Commission) established in December 2023 through the consolidation of Fair Trading and the Office of the Building Commissioner, acts as the central regulator.

The Commission oversees licensing, inspections, compliance enforcement, dispute resolution, and insurance oversight under various Acts, including the Home Building Act 1989 and the Design and Building Practitioners Act 2020. This suggests that a unified regulator can provide a more coordinated and effective approach to consumer protection.

Victoria’s approach seems designed to leverage these efficiencies while addressing past regulatory shortcomings to better protect homeowners and improve industry standards.

A new statutory insurance scheme

One of the most significant changes is the introduction of a statutory insurance scheme (SIS) for residential buildings up to three storeys. Homeowners will no longer need to prove that a builder is insolvent, deceased, or untraceable before making a claim. Accordingly, the SIS will apply to building contracts where the value of the building work exceeds $20,000.

Coverage will apply where a builder fails to comply with a rectification order. Builders must pay the insurance premium before work begins; however, homeowners will still be covered if they do not. The BPC will be the sole provider of insurance, and private insurers will not participate.

Although the SIS does not provide coverage for consultants such as architects, engineers, geotechnical experts, surveyors, and plumbers, we anticipate the industry may see an uptick in notifications as the BPC conducts initial investigations and offers pay outs seeking to recover losses from other potential parties.

NSW has introduced new financial safeguards to address building defects. Decennial Liability Insurance (DLI) now provides first-resort cover for major defects for ten years after completion, allowing owners to claim directly without needing to prove builder insolvency.

According to research conducted by the NSW Government on serious building defects in NSW strata communities, in 2023, 53% of buildings had serious defects, an increase from 39% in 2021. However, reports to the regulator more than doubled, rising from 15% in 2021 to 34% in 2023. For strata schemes registered in NSW since 2020, serious defect rates have decreased from 34% to 27%. Consequently, 48% of strata managers have agreed that reforms have increased consumer confidence.

Developer bond scheme

Developers of apartment buildings with more than three storeys will now be required to participate in a developer bond scheme, which involves lodging a financial security (a bond) prior to applying for an occupancy permit. If building issues are identified and the developer fails to take action, the bond can be called upon to fund rectification works. This aims to shift some of the risk back to developers and encourage proactive compliance.

Financial requirements and land sale restrictions

Builders will now be subject to new minimum financial requirements, with non-compliance potentially leading to disciplinary action, including suspension or cancellation of registration. Additionally, amendments to the Sale of Land Act 1962 will prohibit the registration of certain land where rectification orders remain outstanding.

Our early thoughts on the Act

While the reforms aim to improve consumer protections and lift standards across the building sector, they are likely to have significant consequences for insurers, brokers, developers, and builders.

One expected impact is an increase in claim volumes/notifications. With the SIS operating on a first-resort basis, both insurers and the BPC are likely to see a rise in claim lodgements.

The shift to a government-administered insurance scheme may also alter the role of private insurers in the domestic building market. Although the full extent of the impact remains to be seen, industry expectations indicate that some private insurers may reconsider their participation under the new regime.

Builders and developers will face stricter requirements under the new regulations, including financial thresholds, upfront insurance payments, and rectification obligations. However, challenges remain, including lengthy dispute resolution timelines and the complex interplay between insurance claims and builder accountability. Stakeholders should anticipate ongoing system refinements to address these practical hurdles.

It is also important to be aware that the Act does not clearly address how proportionate liability or contribution claims will be managed, which is likely to complicate dispute resolution. These changes will require careful consideration from stakeholders across the building and insurance sectors, as well as a review of existing contract and risk management practices.

Legal and financial advisors should begin reviewing building contracts, insurance arrangements, and internal processes to prepare for the new regime.