Are Australia's restructuring and insolvency laws up to scratch?

18 July 2023

The Parliamentary Joint Committee on Corporations and Financial Services (Committee) began an inquiry into the effectiveness of Australia’s corporate insolvency laws in September 2022. Led by Senator Deborah O’Neill, the Committee released its report on 12 July 2023 (Report).

The Report can be accessed here.

The Report from this hallmark review may eventually lead to some of the most far-reaching changes to our insolvency laws since the pioneering Australian Law Reform Commission, Report No. 45 in 1988, commonly referred to as the Harmer Report.

The Report acknowledges that the current corporate insolvency laws do not adequately reflect the present business practices and needs.

The Committee revealed that the current corporate insolvency system is overly complex, difficult to access, and creates unnecessary cost and confusion for both debtors and creditors. Unsecured creditors are often left frustrated by the low returns from insolvency processes. Debtors, often smaller and medium sized businesses, regard the corporate insolvency regime as costly and restructuring opportunities as deficient.

The Committee received 78 submissions and supplementary submissions and conducted six public hearings. The concerns about the corporate insolvency laws raised by the submissions included the complexity of the system, poor engagement by debtors, funding gaps, and a problematic division between corporate and personal insolvency law.

The Committee investigated various matters including:

- the trends in corporate insolvency in Australia

- the effectiveness of the existing legislation, common law, and regulatory arrangements, including recent reforms

- other areas for reform, for example, unfair preference claims, trusts with corporate trustee, safe harbours, and international developments

- supporting business access to corporate turnaround capabilities

- the role, remuneration, financial viability, and conduct of corporate insolvency practitioners, and

- the role of government agencies in the corporate insolvency system.

Recommendations

The Committee concluded that, to address deficiencies of the corporate insolvency regime, there needs to be an immediate independent and comprehensive review of the system as a whole, including personal insolvency. The Committee acknowledged that such a review would require considerable investment of time and resources, however, such an investment is required to ensure that the insolvency system is robust and fit-for-purpose.

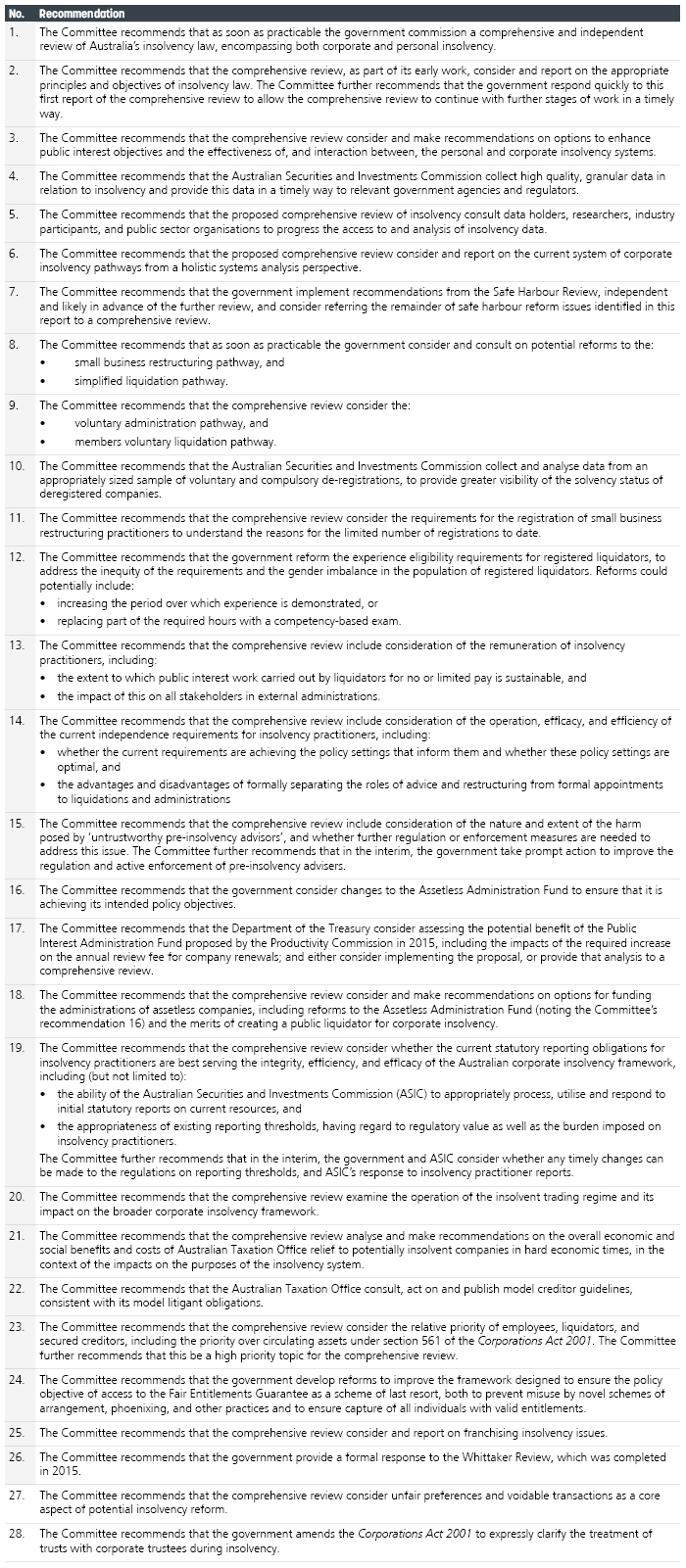

The Committee made 28 recommendations, as follows:

Importantly, the Committee recommends that there be a comprehensive and independent review, particularly for the following recommendations:

- re-examining the principles, purposes, and objectives of the insolvency system (recommendation 2)

- the interaction between the personal and corporate insolvency systems (recommendation 3)

- the need for improved insolvency data (recommendation 5)

- the current system of insolvency pathways, and reforms to specific pathways (recommendations 6, 7 and 9)

- the requirements for the registration of small business restructuring practitioners (recommendation 11)

- remuneration of insolvency practitioners (recommendation 13)

- the independence requirements for insolvency practitioners (recommendation 14)

- issues associated with of ‘untrustworthy pre-insolvency advisors’ (recommendation 15)

- options for funding the administrations of assetless companies, including reforms to the Assetless Administration Fund and the creation of a public liquidator for corporate insolvency (recommendation 18)

- statutory reporting obligations that apply to insolvency practitioners (recommendation 19)

- the operation of the insolvent trading regime and its impact on the broader corporate insolvency framework (recommendation 20)

- overall economic and social benefits and costs of ATO relief to potentially insolvent companies in hard economic times, in the context of the impacts on the purposes of the insolvency system (recommendation 21)

- the relative priority of employees, liquidators and secured creditors (recommendation 23)

- franchising insolvency issues (recommendation 25), and

- unfair preferences and voidable transactions (recommendation 27).

Key recommendations

Harmonisation of corporate and personal insolvency?

The Committee received submissions suggesting that the distinction between the current corporate and personal insolvency is problematic. The Committee acknowledged that a unification of insolvency law under a single insolvency regulator could deliver many benefits. Given the Committee did not analyse personal insolvency law in depth, it considered that the comprehensive review of a harmonisation system should be a priority.

Voidable transaction and unfair preferences

The Committee received evidence suggesting concerns about unfair preference claims in practice. There was support for reforms that balanced the tension between the competing interests of creditors and liquidators. The Committee acknowledged the importance of the principles of the unfair preference and voidable transaction provisions, which provide tools to ensure that assets are distributing equally amongst the creditors. However, the Committee also accepted that there is evidence indicating that unfair preference provisions may not be providing the outcome they are intended to achieve – overall benefit to the creditors. The Committee considered that the reform to the current unfair preference claims regime is in need of a long-term solution, which can be achieved through a comprehensive review.

Where to from here?

The Report illuminates that the Australian insolvency regime is in need for a reform – an immediate one – however the more significant changes to insolvency laws foreshadowed in the Report are likely to come about only after the recommended independent review is conducted. We look forward to updating you on progress in implementing the Committee’s recommendations in the future.