Superannuation

Transactional, advisory and disputes for the super ecosystem

The investment market for superannuation funds is complex and currently navigating significant challenges due to unprecedented transformation and consolidation within the industry.

Increased regulatory scrutiny and a heightened focus on super fund expenditure, administration services, and investment governance are driving industry consolidation. Funds must adapt swiftly while prioritising sustainable outcomes for their members, including investing heavily in robust measures to protect against sophisticated cyber threats.

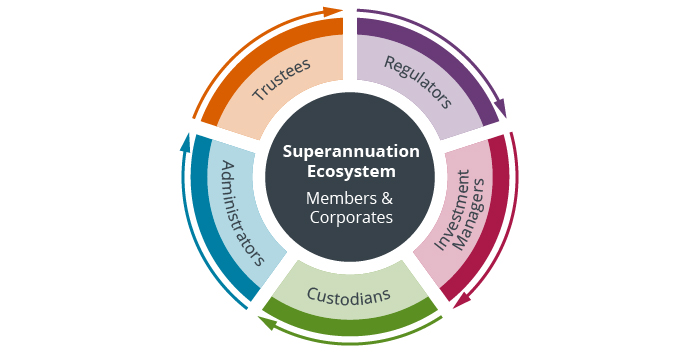

In this transformative environment, access to expert advice is essential. We provide clear, strategic legal advice to all participants in the superannuation ecosystem, including superannuation fund trustees (RSE licensees), their investment managers, administrators, advisors, custodians, corporates, self-managed super funds (SMSFs) and directors.

We have advised on significant industry super fund mergers (successor funds transfers), wind-ups and major outsourcing of administration, custody and investment management. We have advised on some of the largest transactions in the market, and across all asset classes. We advise all funds including the largest super funds, global managers and stakeholders.

Our breadth of services

Whether you’re launching a new product, outsourcing core functions, undertaking a successor fund transfer or navigating complex regulatory change, our experienced team offers practical legal support and advice across governance, investments, operations, and compliance.

Our expertise also encompasses broader regulatory issues, including superannuation and regulatory requirements, licensing, design and distribution obligations as well as disclosure and compliance requirements under the Australian financial services regime, including the financial accountability regime (FAR). We assist clients with investor and member disputes, breach reporting and remediation. In addition, our team manages mandates with environmental, social and governance (ESG) considerations, addressing issues such as greenwashing, sanctions, and modern slavery risks.

We also provide comprehensive guidance on all aspects of investments for superannuation funds. This includes support for superannuation and other institutional investors in their investment-related matters, drawing on the team’s deep experience in Australian and international equities, cash and fixed income, property, private equity, alternative assets and infrastructure.

We’re proud to be one of the few firms in Australia offering comprehensive expertise across superannuation, investments, advisory and disputes—all within one integrated team. Our legal team has worked at top global and national firms and in-house within leading super investment teams.

Our team

Our partners work collaboratively as one team to achieve your goals.

Our team, led by Stephen Putnins in Melbourne, specialises in significant superannuation fund mergers and wind-ups, investments and managed investment schemes. Stephen specialises in superannuation, funds management, investments, and financial services law, with a particular focus on funds and financial services regulation. He regularly advises on major projects, general corporate and operational matters, outsourcing, cross-border transactions, acquisitions and divestments, derivatives, due diligence, governance, disclosure, regulatory and compliance matters, investor and member disputes, and remediation. Stephen has significant experience across all asset classes, including Australian and international equities, debt, cash and fixed income, property funds, private equity, and infrastructure, including multiple billion-dollar public-private partnerships (PPPs).

Stephen’s extensive regulatory experience includes advising on compliance with financial services regulations such as AML/CTF, the Financial Accountability Regime (FAR, and its predecessor BEAR), reasonable steps frameworks, accountability statements, and product design and distribution obligations. Stephen also assists client in navigating complex regulatory frameworks, and liaising with regulatory bodies including APRA, ASIC, and Austrac. Stephen is also an expert in ESG, modern slavery and sanctions.

Peter Charteris leads the team in Sydney and undertakes superannuation and funds management work. He acts as a general legal advisor to a number of industry superannuation funds and has advised on some of the largest individual transactions in the superannuation industry.

His superannuation work covers all legal issues applying to superannuation funds, including regulatory and general law obligations, member communications, key service provider contracts, member disputes and investment.

Peter advises trustees of superannuation funds on a wide range of matters, including product disclosure, annual reporting, standard ISDA terms, new administration agreements, the appointment of new custodians, successor fund transfers, and member disputes.

As a general legal advisor, Peter supports a superannuation scheme with over 90,000 members and assets exceeding AU$6 billion.

He represents trustees in complex death benefit claims, reviewing medical evidence in total and permanent disability (TPD) claims and assessing submissions to the Australian Financial Complaints Authority (AFCA).

His experience includes acting for a Federal Government department in outsourcing the administration of one of its accumulation superannuation funds and advising a specialised financial services organisation on the appointment of a new custodian.

Additionally, Peter provides guidance on trustee duties and trust deeds, assists with the appointment of new service providers for administration, custody, and investment, and advises on administration contracts, Australian Financial Services Licences, and public offer status.

He has acted on successor fund transfers for industry superannuation funds and obtained managed investment relief for employee entitlement funds. His work also includes advising trustees on the appointment of new group life insurers and supporting multiple trustees with their individual investments in US Real Estate Investment Trusts (REITs) and Cayman investment companies.

With over 48 years’ experience in compliance, risk, and governance, Marianne Robinson brings extensive expertise as both in-house corporate counsel and executive management. Marianne was the legal adviser for the first AFS licence issued in Australia and has since obtained AFS licences for a range of different entities since then and she has expertise in the non-cash payment facility areas including credit cards and stored value cards. She has worked with the Reserve Bank in relation to the first virtual payment systems, surcharging and payment transaction issues.

Marianne designs and reviews corporate compliance programs, governance frameworks, charters, policies, and codes of conduct. She specialises in assisting boards with balancing compliance and regulatory challenges and reviewing services provided by APRA regulated entities.

Marianne develops policies and protocols for conflicts of interest, bribery and corruption, trade sanctions, privacy, AML/CTF, directors’ duties, delegated authority, risk management strategies, and APRA prudential standards across the ADI, life, general, and superannuation sectors.

We take the time to truly understand your fund—its unique structure, strategy, and the people behind it. Our team works alongside yours to deliver tailored advice, seamless transactional solutions and effective disputes resolution.

We’re committed to delivering value through cost efficient solutions that align with members’ best interests. So let’s collaborate and help you achieve your strategic goals.

See our Funds and Financial Services Team page for more information.

Melbourne

Partner

t: +61 3 9291 2392+61 3 9291 2392

m: +61 428 641 561+61 428 641 561

o: Melbourne

Sydney

Partner

t: +61 2 9260 2556+61 2 9260 2556

m: +61 412 368 176+61 412 368 176

o: Sydney

Special Counsel

t: +61 2 9260 2755+61 2 9260 2755

m: +61 460 310 444+61 460 310 444

o: Sydney